Cepheo Advanced Ledger Import

Cepheo Business Documents

Document examples

Business Documents configuration

General for all documents

Sales order configuration

Sales invoice

Sales packing slip

Purchase order

Project invoice

Quotation

Interest note

Work report

Dynamic payment information

Release notes Cepheo Business Documents

Cepheo Currency Import

Cepheo Engineering

Cepheo Engineering - Functional overview

Engineering setup

Engineering parameters

Engineering global parameteres

Change notification parameters

Classification Codes Setup

Item property setup

Manufacturer Setup

Material Quality Setup

Product setup

Spare Parts Setup

Released Item Setup

How to use Engineering

Release overview Engineering

Cepheo Expense Extension

Cepheo Expense Power App

Cepheo Foundation

HowTo

License overview

Model upload

Business events

Release overview Foundation

Release notes Foundation

Base.2022.11.2.21

Base.2022.8.2.19

Base.2022.8.2.16

Base.2022.8.2.15

Base.2022.2.2.11

Base.2022.2.2.10

What is Cepheo Foundation

Cepheo Human Resources Extension

Setup Human Resources Extension

Use Human Resources Extension

Release notes Human Resources Extension

What is Human Resources Extension

Cepheo Installation

Setup Installation

How to use Installation

Release overview Installation

Cepheo MVA-melding

MVA Setup

MVA Reporting

Step 4: Reporting

Step 4 | Section 1: Tax reports

Step 4 | Section 2: Standard tax codes

Step 4 | Section 3: Tax specifications

Step 4 | Section 4: Report remark

MVA Multicompany setup

MVA Intercompany setup

MVA Intercompany Tax report

Cepheo SAF-T reporting

Cepheo Sales Integration

Cepheo Shipment Booking

Shipment booking setup

Shipment booking external values

Transform addresses, senders and recipients to address quick ID's

Transform label

Transform carrier information

Transform country, state and county

Transform currency code

Transform print favorite

Transform shipment payer account

Transform container types

Transform shipment booking status

Transform security group

Shipment booking parameters

Document transformations

Shipment booking senders

Shipment booking labels

Shipment booking print favorites

Shipment booking security group (nShift Delivery)

Carrier container type

Shipment booking cost rule

Import Carrier setup

Setup of carriers

Shipment booking Sender

Shipment booking app setup

How to use Shipment booking

Notification contacts

Consolidate shipment bookings from Create Shipment booking dialog

Maintain content lines on a Container on a Shipment booking

Release overview Shipment booking

Cepheo Subscription

Cepheo Test and Certification

Cepheo Timesheet Extension

- All Categories

- Cepheo MVA-melding

- MVA Setup

- Step 3: Tax codes reference (Mapping)

Step 3: Tax codes reference (Mapping)

As the Tax Authority will only accept reporting using the Standard Tax Codes, all the active tax codes of your company (in the reported date-interval) must be mapped (pointed to) the Standard tax codes imported from the Tax authority.

After importing all the files, it is time for mapping your own tax codes with standard tax codes from the Tax Authority.

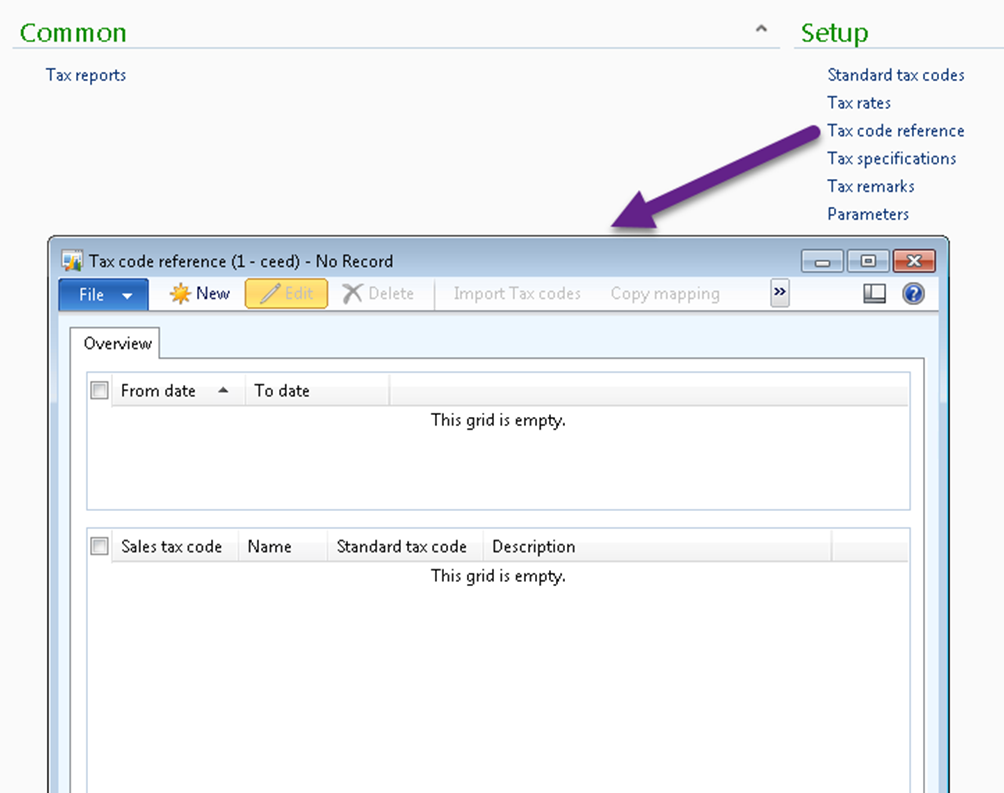

Locate the Tax Report Area page > Setup and open the Tax code reference form.

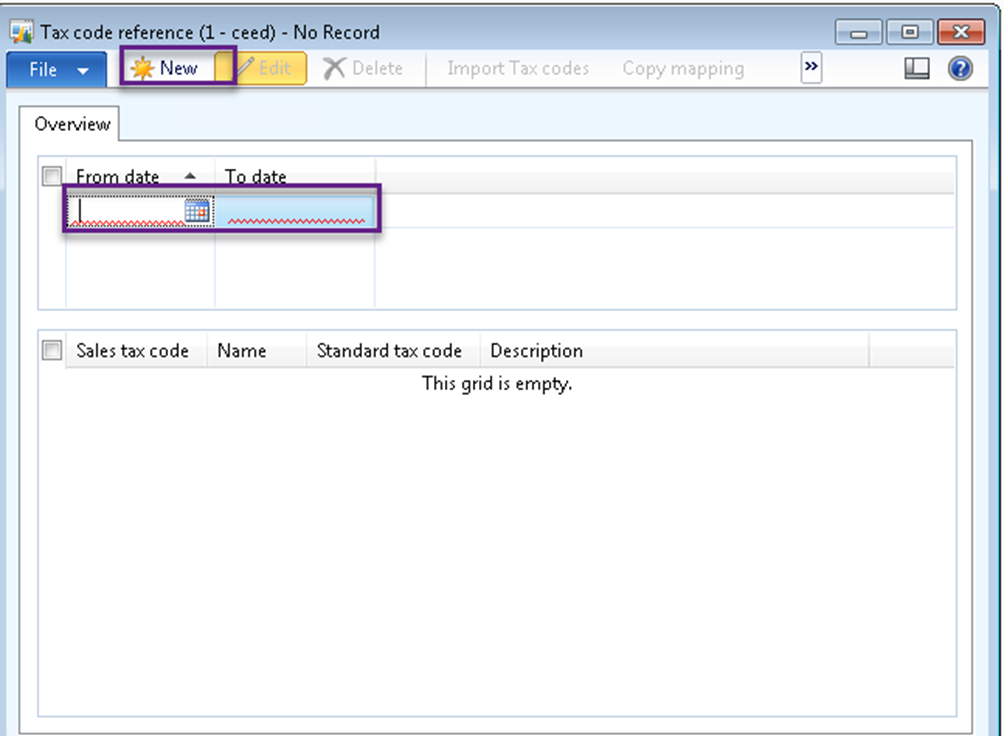

To be able to map the tax codes, you must create a period which often would be the same as the accounting period.

To create a new period, you can either click on New button or Press Ctrl+n. Then you can enter the period that will cover the reporting period.

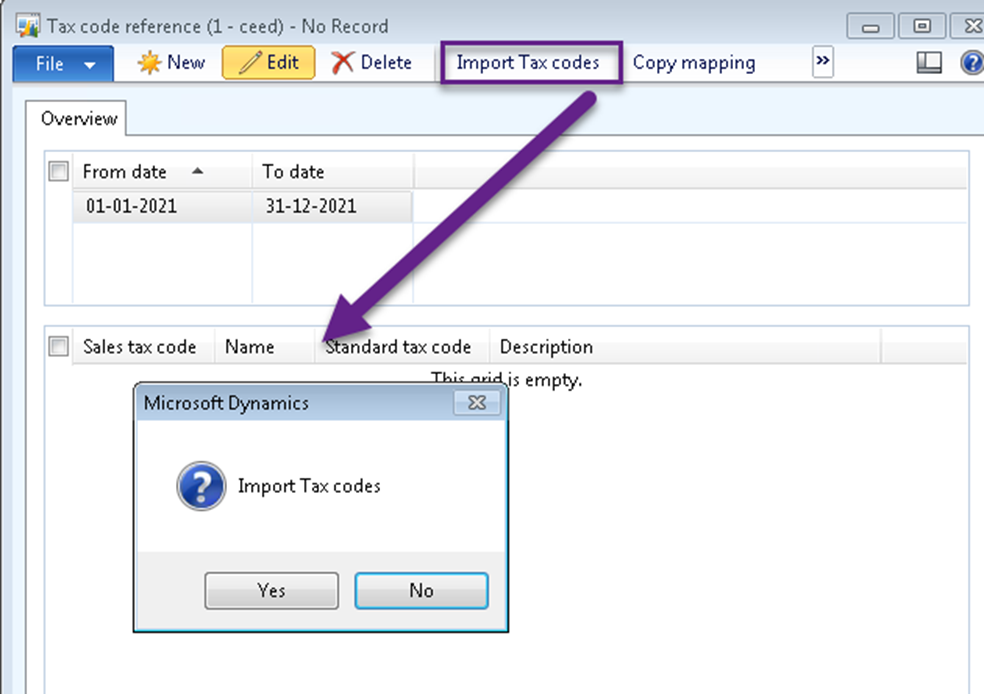

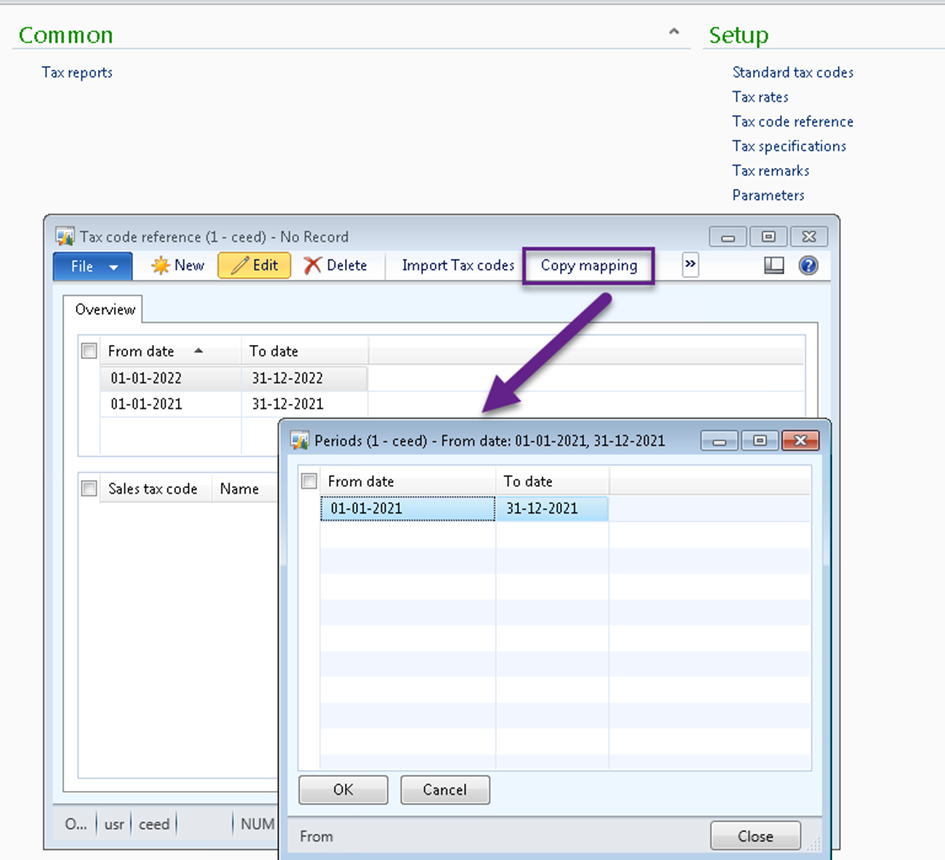

After creating the period, the “Import Tax codes” and “Copy mapping” buttons are activated.

- Import Tax codes

You can click on this button and choose “Yes” to the Import Tax Code Dialog, to import (copy) your tax codes.

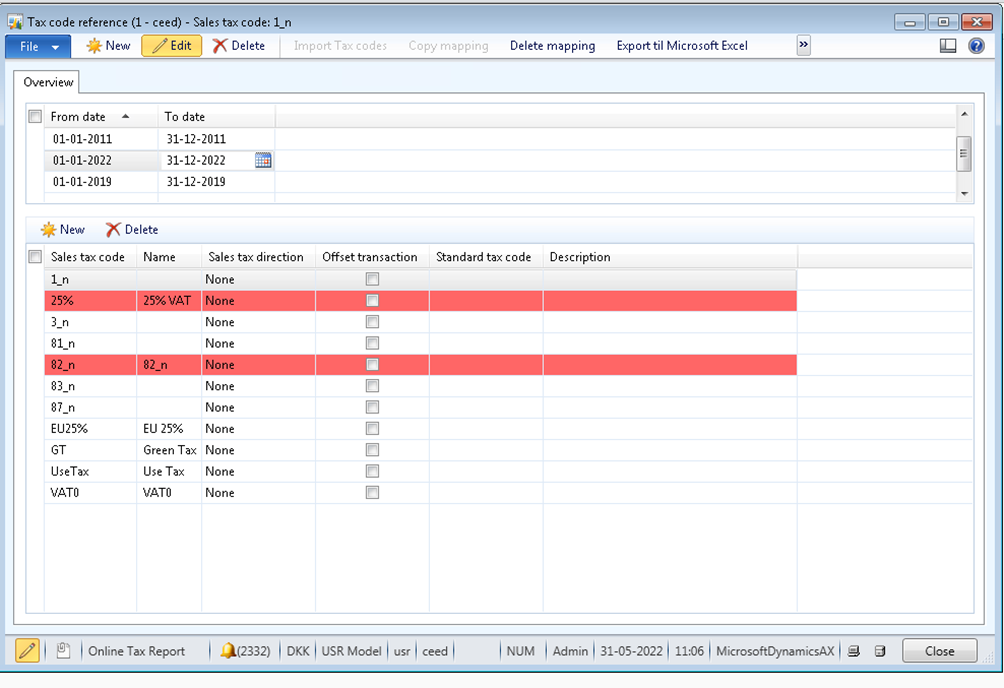

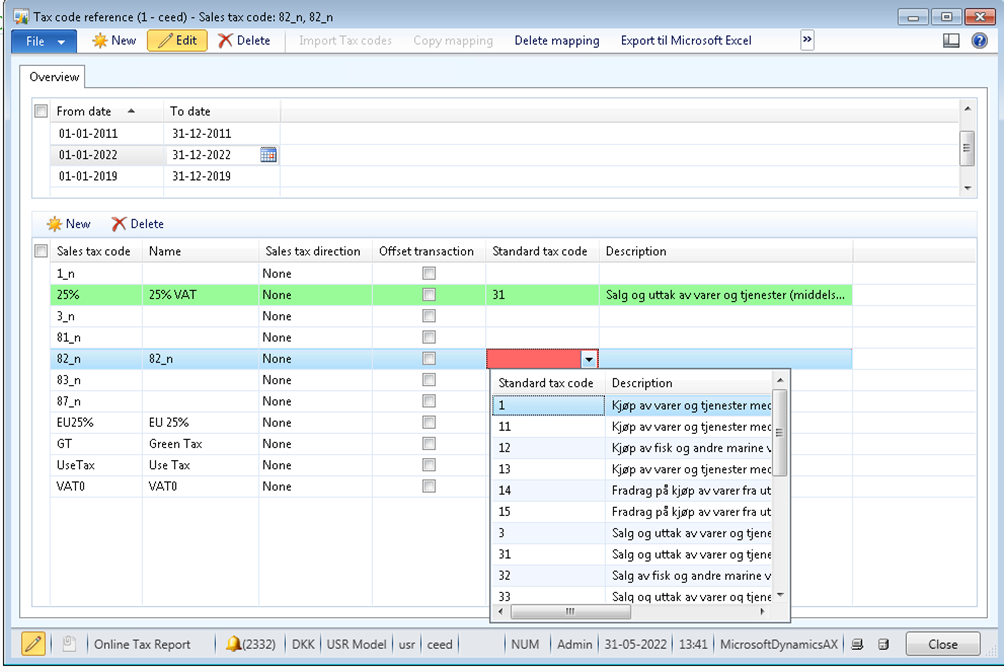

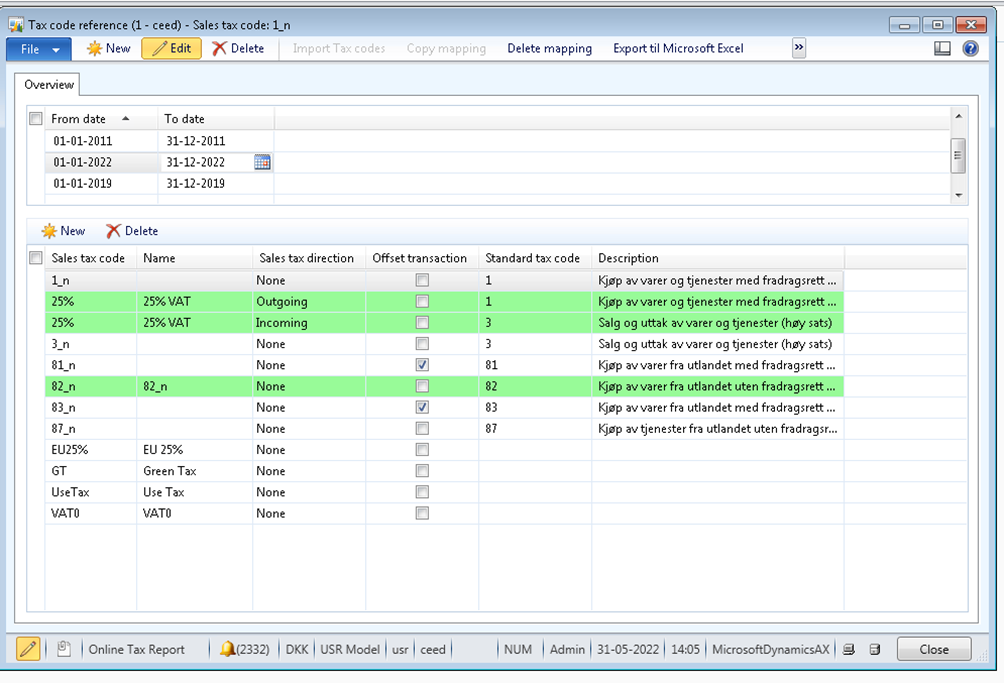

After importing your system Tax code, some records appear with red background. The red color record indicates that there are transactions in those tax codes in the given period and should be mapped. Any tax code of your company that is NOT mapped, will NOT be included in Tax reporting.

Select the individual line from your own Tax codes (left) and then choose which standard tax code from the Tax authorities (right) that matches it.

After mapping each tax code, the record background color changes to green.

- Please note:

The Offset transactions column for Sales Tax Codes 81, 82, 83, 84, 85, 86, 87, 88, 89, 91 MUST be marked if present. This is required from Tax authorities.

- Copy mapping:

If you have created a new and empty period and you have already mapped periods from previous years you will be able to copy mapping from earlier periods by clicking Copy mapping. Then you can choose a period to copy from and make changes if required.

This ability to periodically set up mapping, will let you go back in time and see former used mappings with possibility to change mappings during the periods (to meet the requirements from Tax Authority – “Skatteetaten”).