Cepheo Advanced Ledger Import

Cepheo Business Documents

Document examples

Business Documents configuration

General for all documents

Sales order configuration

Sales invoice

Sales packing slip

Purchase order

Project invoice

Quotation

Interest note

Work report

Dynamic payment information

Release notes Cepheo Business Documents

Cepheo Currency Import

Cepheo Engineering

Cepheo Engineering - Functional overview

Engineering setup

Engineering parameters

Engineering global parameteres

Change notification parameters

Classification Codes Setup

Item property setup

Manufacturer Setup

Material Quality Setup

Product setup

Spare Parts Setup

Released Item Setup

How to use Engineering

Release overview Engineering

Cepheo Expense Extension

Cepheo Expense Power App

Cepheo Foundation

HowTo

License overview

Model upload

Business events

Release overview Foundation

Release notes Foundation

Base.2022.11.2.21

Base.2022.8.2.19

Base.2022.8.2.16

Base.2022.8.2.15

Base.2022.2.2.11

Base.2022.2.2.10

What is Cepheo Foundation

Cepheo Human Resources Extension

Setup Human Resources Extension

Use Human Resources Extension

Release notes Human Resources Extension

What is Human Resources Extension

Cepheo Installation

Setup Installation

How to use Installation

Release overview Installation

Cepheo MVA-melding

MVA Setup

MVA Reporting

Step 4: Reporting

Step 4 | Section 1: Tax reports

Step 4 | Section 2: Standard tax codes

Step 4 | Section 3: Tax specifications

Step 4 | Section 4: Report remark

MVA Multicompany setup

MVA Intercompany setup

MVA Intercompany Tax report

Cepheo SAF-T reporting

Cepheo Sales Integration

Cepheo Shipment Booking

Shipment booking setup

Shipment booking external values

Transform addresses, senders and recipients to address quick ID's

Transform label

Transform carrier information

Transform country, state and county

Transform currency code

Transform print favorite

Transform shipment payer account

Transform container types

Transform shipment booking status

Transform security group

Shipment booking parameters

Document transformations

Shipment booking senders

Shipment booking labels

Shipment booking print favorites

Shipment booking security group (nShift Delivery)

Carrier container type

Shipment booking cost rule

Import Carrier setup

Setup of carriers

Shipment booking Sender

Shipment booking app setup

How to use Shipment booking

Notification contacts

Consolidate shipment bookings from Create Shipment booking dialog

Maintain content lines on a Container on a Shipment booking

Release overview Shipment booking

Cepheo Subscription

Cepheo Test and Certification

Cepheo Timesheet Extension

- All Categories

- Cepheo MVA-melding

- MVA Multicompany setup

- MVA Multicompany setup

MVA Multicompany setup

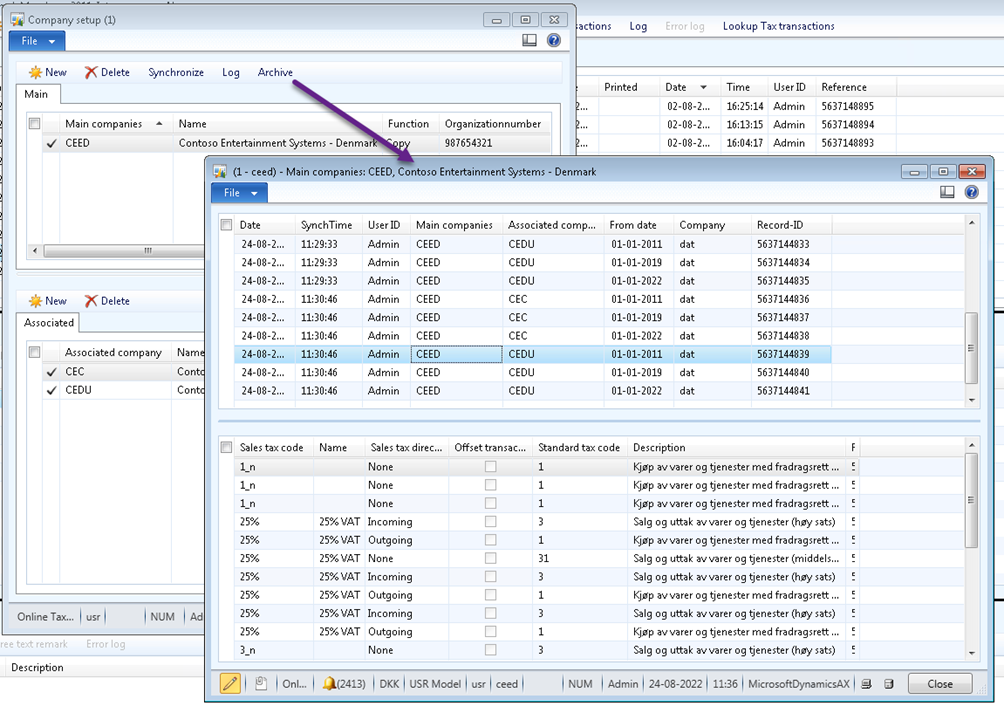

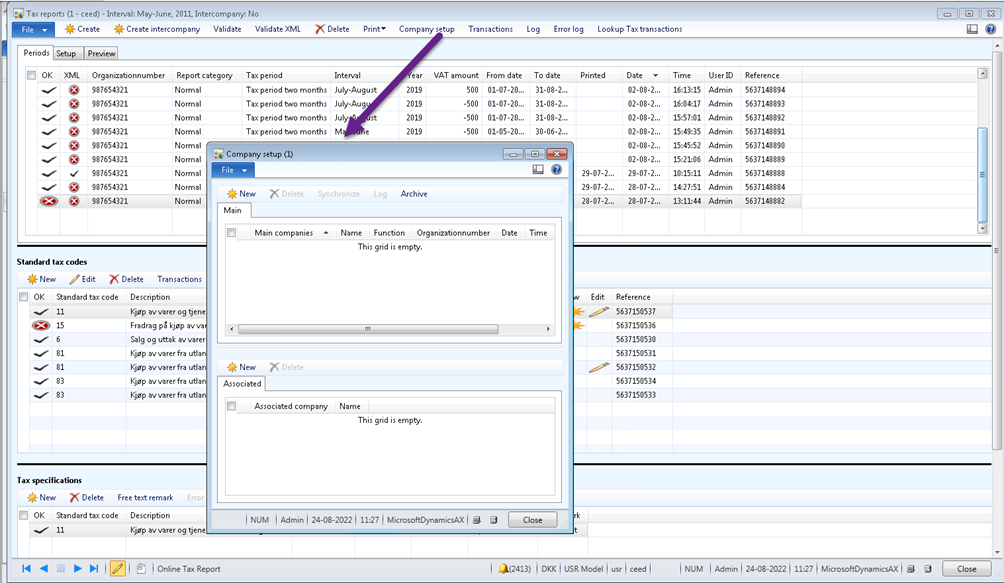

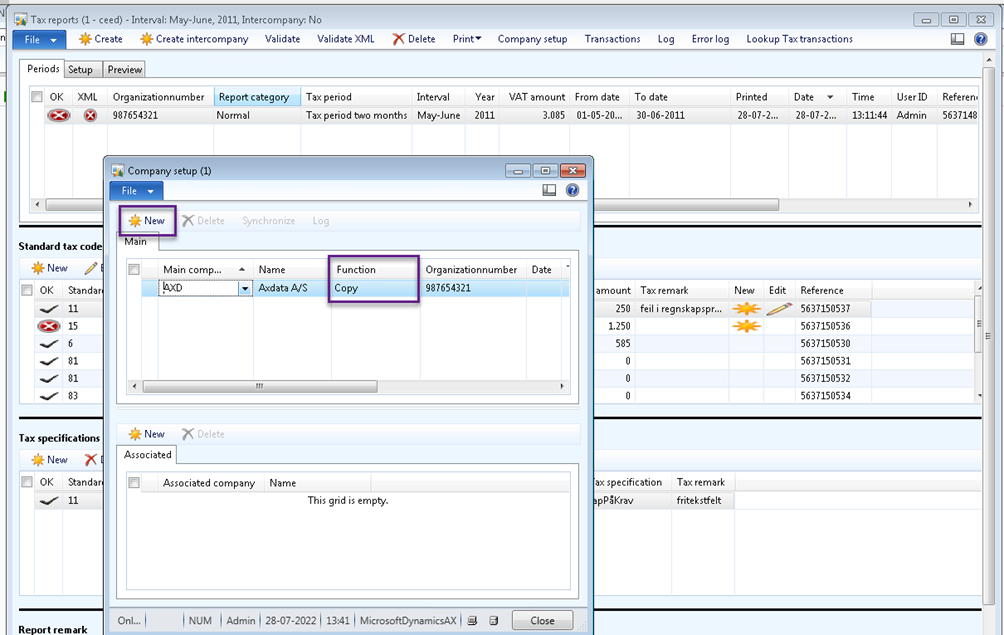

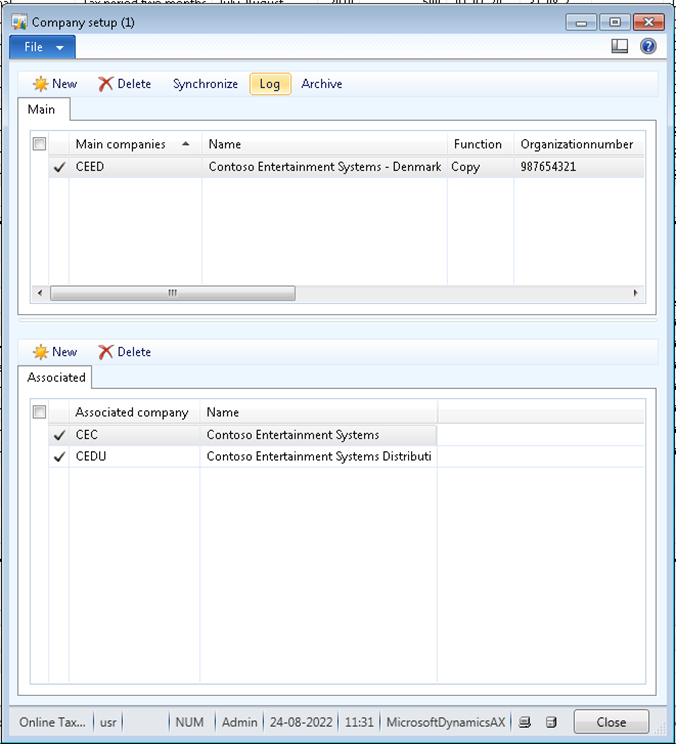

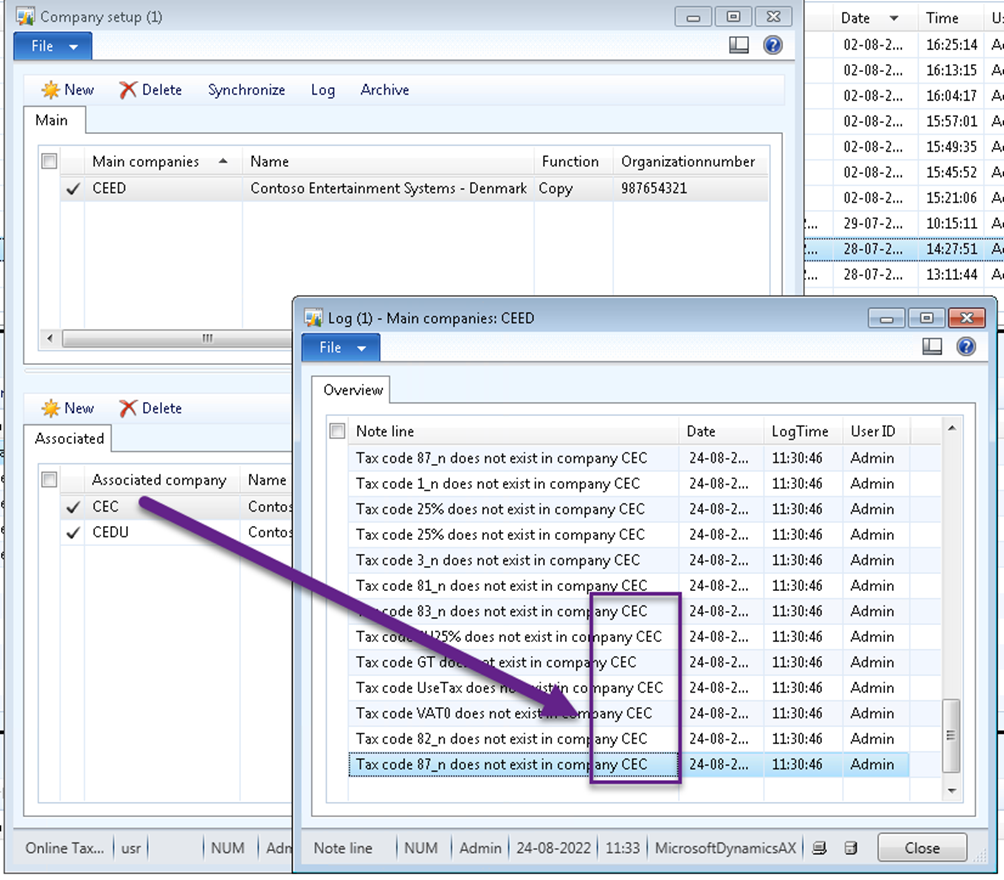

By clicking on the Company setup button on the Tax report menu, you can setup multicompany functionality. Choose a company from the lookup menu list as a Main company and in the lower section choose the companies as associated companies.

Maincompany section button

- New:

Works the same both in the Main company and the Associated companies. creates a new record. Please note: It is very important that Function field type is set to Copy. The Main company can be a part of associated company in the same setup. - Delete:

Deletes the whole setup, both in the Main and Associated section. Delete button in Associated companies deletes only the highlighted record. - Synchronize:

After creating both the Main company and Associated companies, by clicking on this button it copies the whole setup from the main Company to the Associated companies. It keeps the Associated company’s setup and adds the Tax code from the Main company which are missing in the Tax code reference setup in associated companies. After synchronization if there are some errors, the records with the error will be marked with the red (x). The most common error is the missing Sales tax code in one of the companies which you can find in the log form. It is important that all the Sales tax code are the same in all the companies which are a part of the Multicompany setup. - Log:

By clicking on this button, you can see the history of Synchronization for the whole setup. If there are some errors, you can find them in this form and then take actions accordingly.

Archive button – by clicking on this button you can see the history Multicompany setup. If a setup would be deleted, you can always find it from this form.