Cepheo Advanced Ledger Import

Cepheo Business Documents

Document examples

Business Documents configuration

General for all documents

Sales order configuration

Sales invoice

Sales packing slip

Purchase order

Project invoice

Quotation

Interest note

Work report

Dynamic payment information

Release notes Cepheo Business Documents

Cepheo Currency Import

Cepheo Engineering

Cepheo Engineering - Functional overview

Engineering setup

Engineering parameters

Engineering global parameteres

Change notification parameters

Classification Codes Setup

Item property setup

Manufacturer Setup

Material Quality Setup

Product setup

Spare Parts Setup

Released Item Setup

How to use Engineering

Release overview Engineering

Cepheo Expense Extension

Cepheo Expense Power App

Cepheo Foundation

HowTo

License overview

Model upload

Business events

Release overview Foundation

Release notes Foundation

Base.2022.11.2.21

Base.2022.8.2.19

Base.2022.8.2.16

Base.2022.8.2.15

Base.2022.2.2.11

Base.2022.2.2.10

What is Cepheo Foundation

Cepheo Human Resources Extension

Setup Human Resources Extension

Use Human Resources Extension

Release notes Human Resources Extension

What is Human Resources Extension

Cepheo Installation

Setup Installation

How to use Installation

Release overview Installation

Cepheo MVA-melding

MVA Setup

MVA Reporting

Step 4: Reporting

Step 4 | Section 1: Tax reports

Step 4 | Section 2: Standard tax codes

Step 4 | Section 3: Tax specifications

Step 4 | Section 4: Report remark

MVA Multicompany setup

MVA Intercompany setup

MVA Intercompany Tax report

Cepheo SAF-T reporting

Cepheo Sales Integration

Cepheo Shipment Booking

Shipment booking setup

Shipment booking external values

Transform addresses, senders and recipients to address quick ID's

Transform label

Transform carrier information

Transform country, state and county

Transform currency code

Transform print favorite

Transform shipment payer account

Transform container types

Transform shipment booking status

Transform security group

Shipment booking parameters

Document transformations

Shipment booking senders

Shipment booking labels

Shipment booking print favorites

Shipment booking security group (nShift Delivery)

Carrier container type

Shipment booking cost rule

Import Carrier setup

Setup of carriers

Shipment booking Sender

Shipment booking app setup

How to use Shipment booking

Notification contacts

Consolidate shipment bookings from Create Shipment booking dialog

Maintain content lines on a Container on a Shipment booking

Release overview Shipment booking

Cepheo Subscription

Cepheo Test and Certification

Cepheo Timesheet Extension

- All Categories

- Cepheo MVA-melding

- MVA Setup

- Step 1: Parameter setup

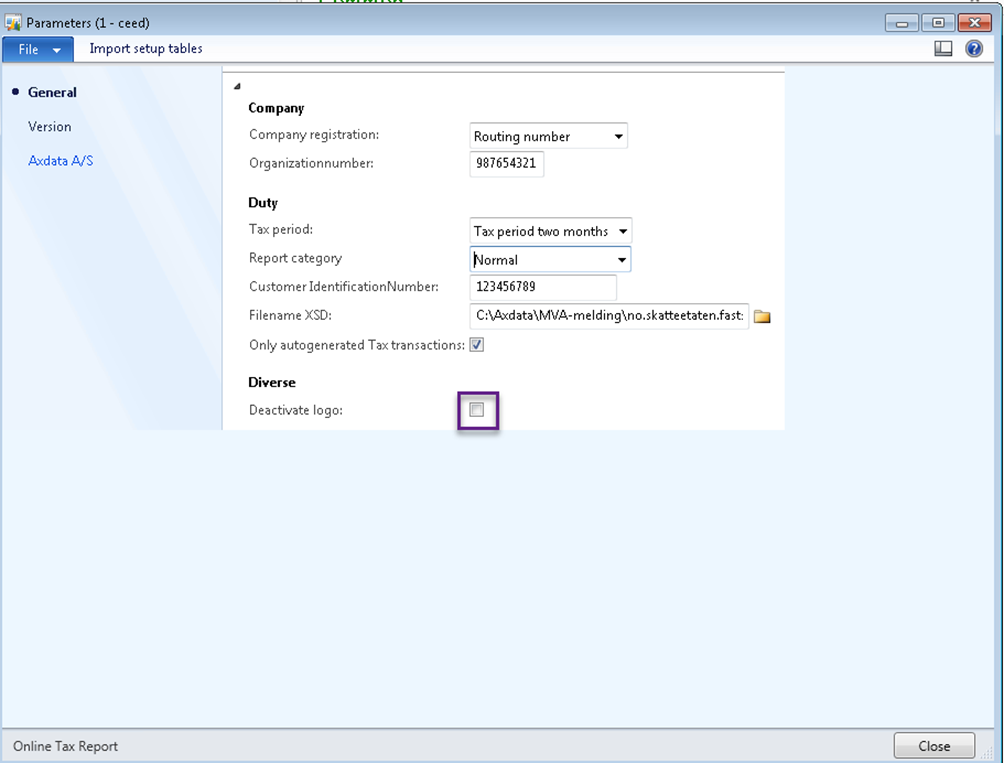

Step 1: Parameter setup

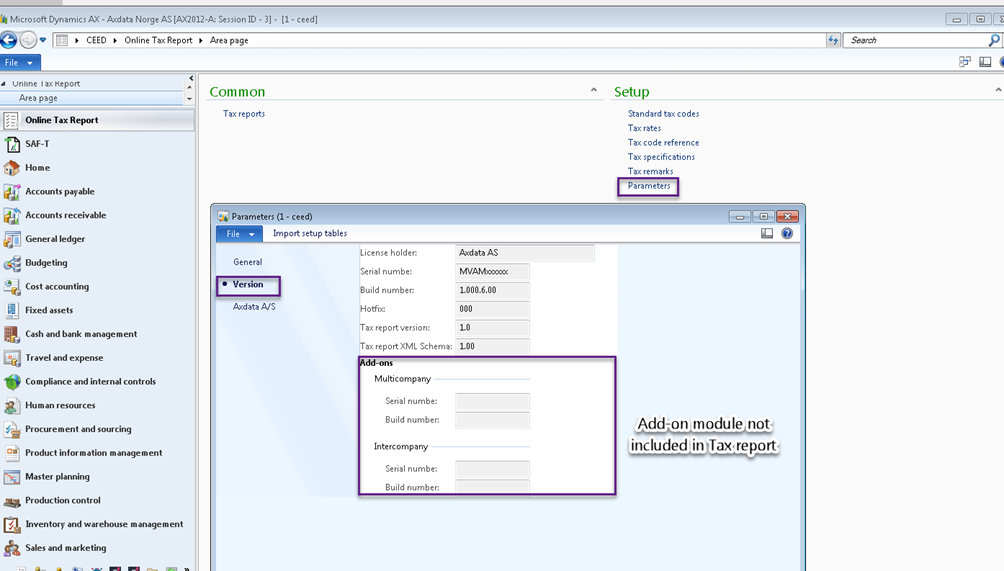

Locate the Tax report Area Page / open setup parameters form MVA > Tax Report > Area Page > Setup > Parameters

Version Tab

Serial number and license holder are pre-entered.

In the Version Tab of parameters form you can always find information regarding:

- Current Tax Report add on module version

- Build and Version no.

- Hotfix

- Tax Authority report version

- Tax Authority XML Schema

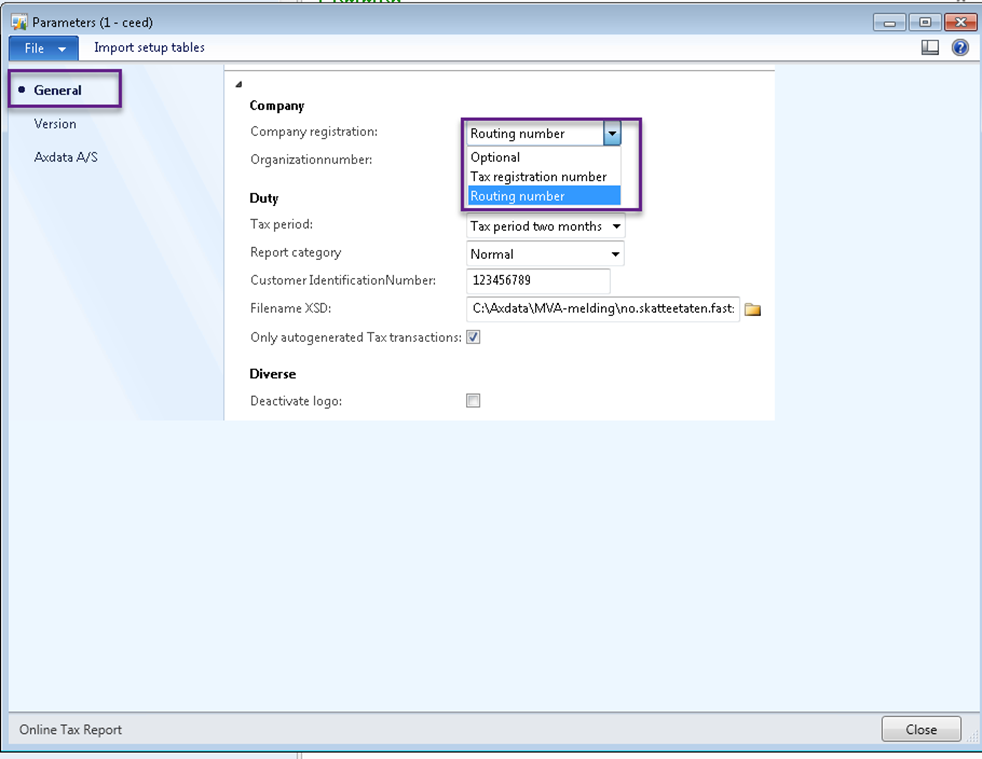

General Tab

Company registration:

In the General-section you can choose which company-registration to include in the reporting file:

- Optional: You can enter the 9-digit reg-number.

- Tax registration number/Routing number: Fetch the tax registration or routing number from company information.

The field is edidtable and must consist of 9 digits.

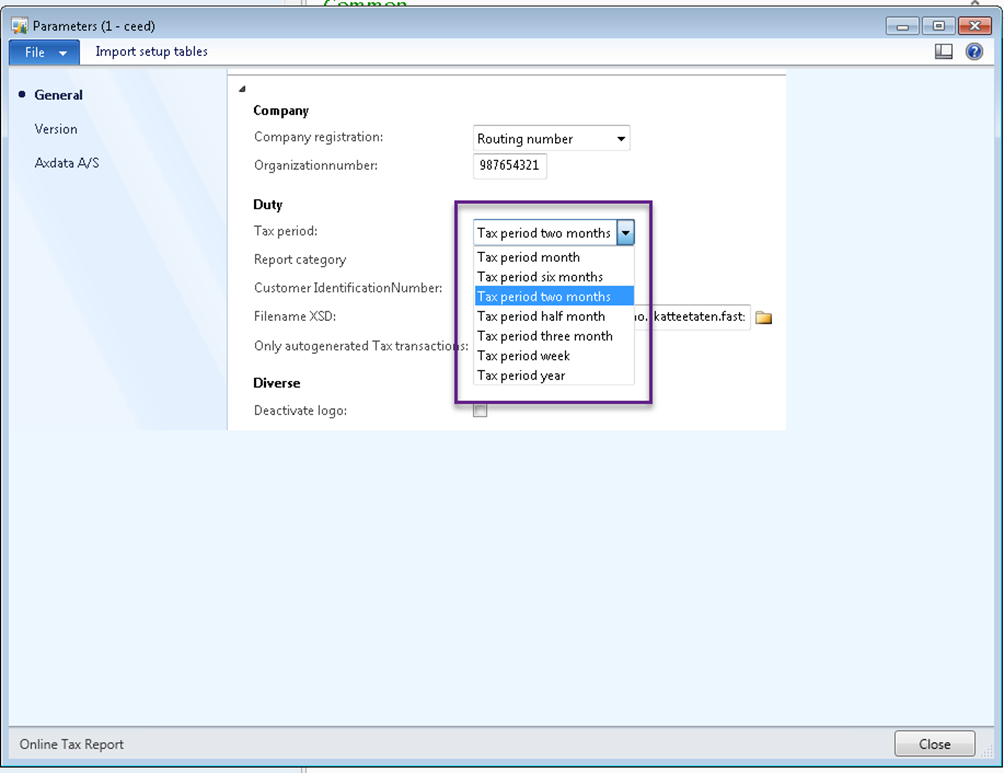

Tax period:

In the next section you can select reporting time interval in which you must send the Tax reports to the Tax authorities.

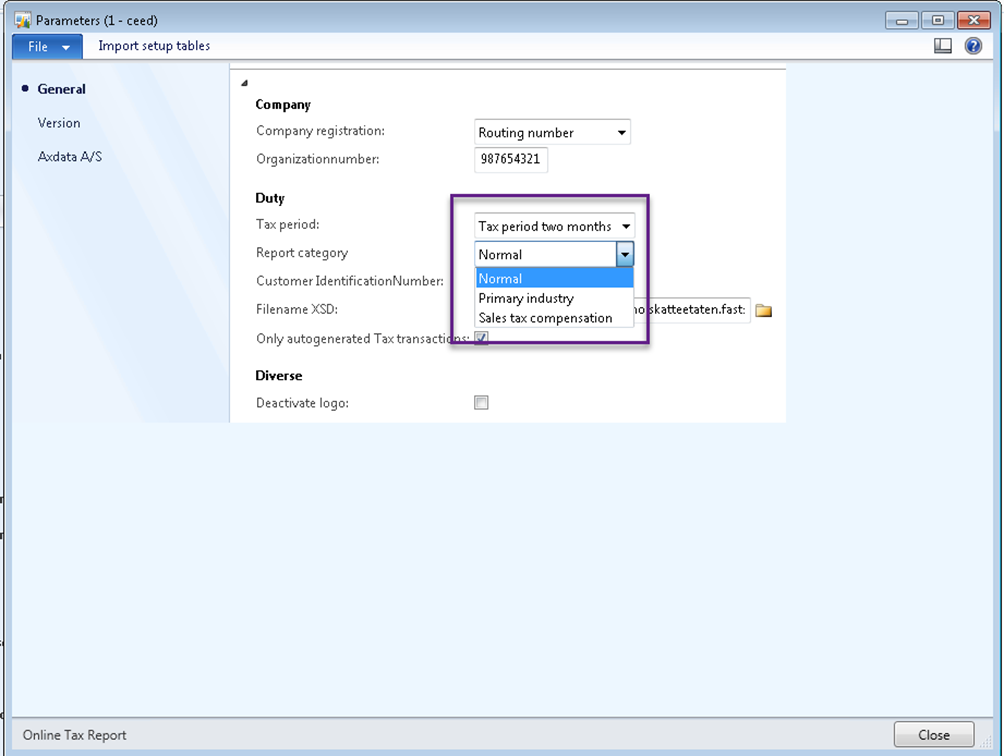

Report category:

In the Report category you can change the Report category as it is agreed with the Tax Authority. In most case the Report category setup is set to “Normal”.

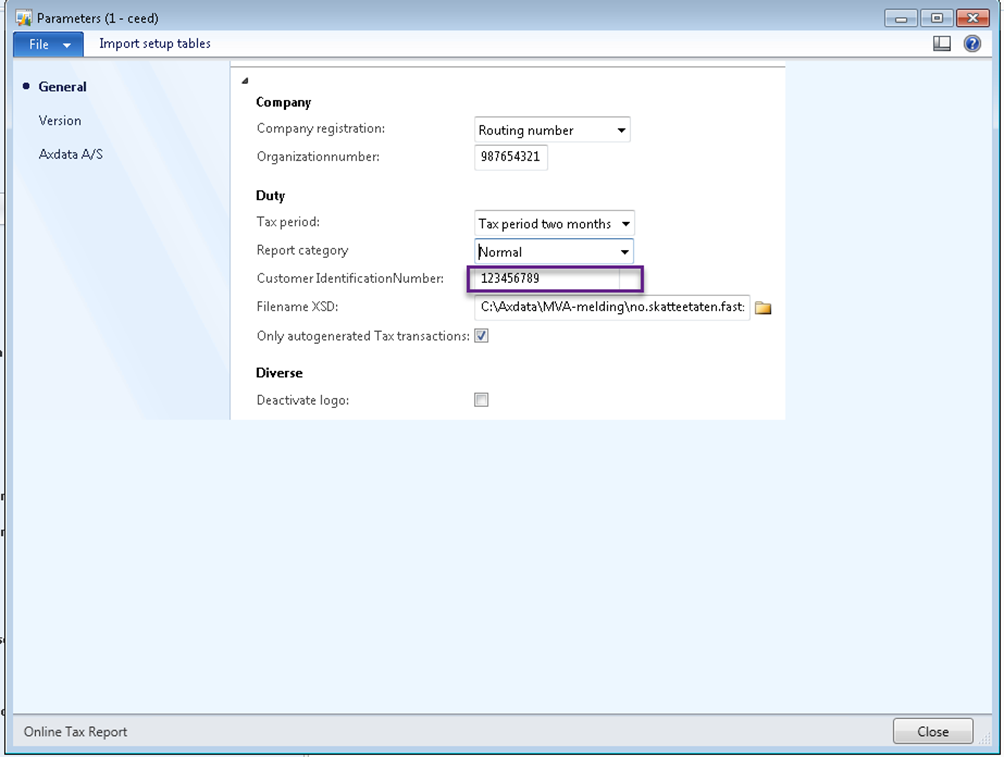

Customer Identification Number (KID):

Customer Identification Number is either a KID Bank Account, IBAN no, SWIFT no. or might be another any valid company Bank Account. The account is used to return the Tax amount if it is in your favor. This information can be entered either in Parameters or directly after creating the Tax report. This information is mandatory if tax is returned but must be left blank if tax payment is due to you.

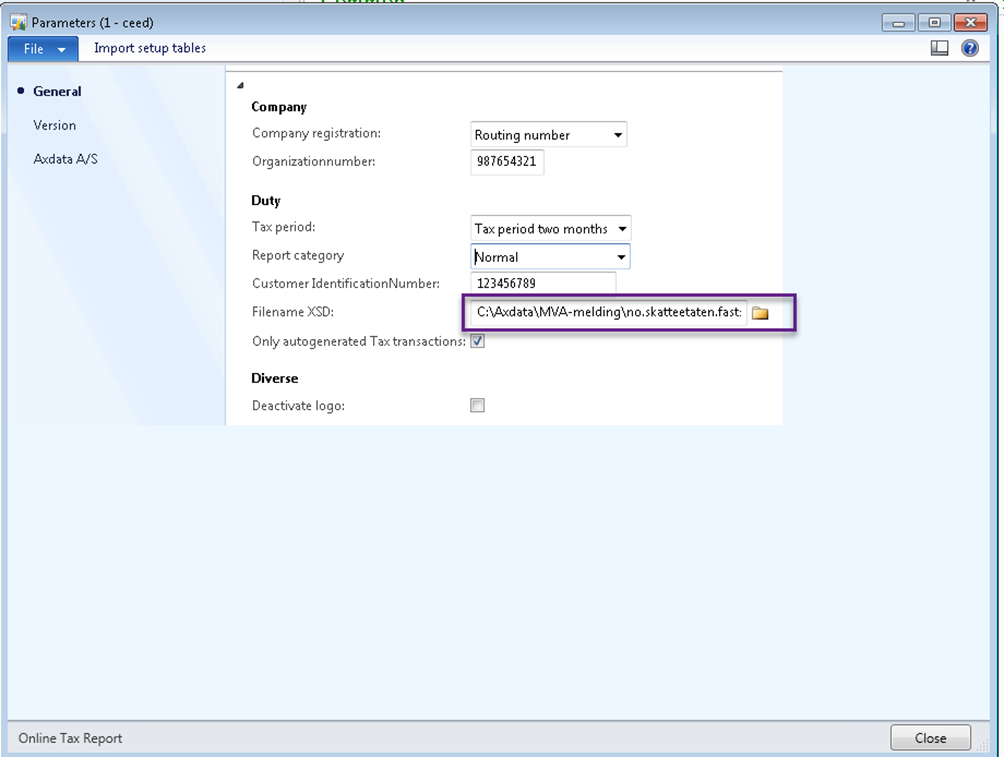

Filename XSD:

The Filename XSD field is intended to enter the path of the Validation schema file: “no.skatteetaten.fastsetting.avgift.mva.skattemeldingformerverdiavgift.v1.0.xsd”. If the directory path of the schema-file exists, you can validate the Tax report before uploading it to the Tax authorities. It is recommended to validate the report before uploading.

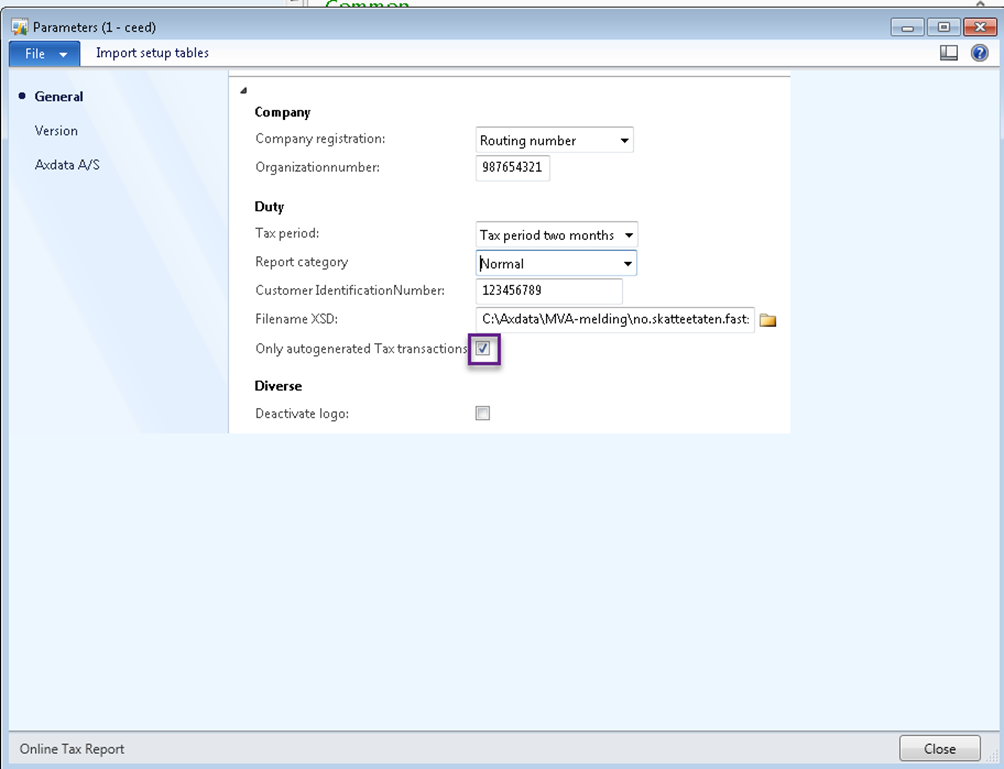

Only autogenerated Tax transactions:

If marked, the Only autogenerated Tax transactions field is used to report only the autogenerated Tax transactions in the system. Manually entered tax transactions will not be reported. We will get back to it in the Report section.

Deactivate logo:

If marked this field will prevent the Cepheo Logo to be shown in the Cepheo A/S tab.

CepheoA/S Tab

Here you can find the Cepheo contact information.