Cepheo Advanced Ledger Import

Cepheo Business Documents

Document examples

Business Documents configuration

General for all documents

Sales order configuration

Sales invoice

Sales packing slip

Purchase order

Project invoice

Quotation

Interest note

Work report

Dynamic payment information

Release notes Cepheo Business Documents

Cepheo Currency Import

Cepheo Engineering

Cepheo Engineering - Functional overview

Engineering setup

Engineering parameters

Engineering global parameteres

Change notification parameters

Classification Codes Setup

Item property setup

Manufacturer Setup

Material Quality Setup

Product setup

Spare Parts Setup

Released Item Setup

How to use Engineering

Release overview Engineering

Cepheo Expense Extension

Cepheo Expense Power App

Cepheo Foundation

HowTo

License overview

Model upload

Business events

Release overview Foundation

Release notes Foundation

Base.2022.11.2.21

Base.2022.8.2.19

Base.2022.8.2.16

Base.2022.8.2.15

Base.2022.2.2.11

Base.2022.2.2.10

What is Cepheo Foundation

Cepheo Human Resources Extension

Setup Human Resources Extension

Use Human Resources Extension

Release notes Human Resources Extension

What is Human Resources Extension

Cepheo Installation

Setup Installation

How to use Installation

Release overview Installation

Cepheo MVA-melding

MVA Setup

MVA Reporting

Step 4: Reporting

Step 4 | Section 1: Tax reports

Step 4 | Section 2: Standard tax codes

Step 4 | Section 3: Tax specifications

Step 4 | Section 4: Report remark

MVA Multicompany setup

MVA Intercompany setup

MVA Intercompany Tax report

Cepheo SAF-T reporting

Cepheo Sales Integration

Cepheo Shipment Booking

Shipment booking setup

Shipment booking external values

Transform addresses, senders and recipients to address quick ID's

Transform label

Transform carrier information

Transform country, state and county

Transform currency code

Transform print favorite

Transform shipment payer account

Transform container types

Transform shipment booking status

Transform security group

Shipment booking parameters

Document transformations

Shipment booking senders

Shipment booking labels

Shipment booking print favorites

Shipment booking security group (nShift Delivery)

Carrier container type

Shipment booking cost rule

Import Carrier setup

Setup of carriers

Shipment booking Sender

Shipment booking app setup

How to use Shipment booking

Notification contacts

Consolidate shipment bookings from Create Shipment booking dialog

Maintain content lines on a Container on a Shipment booking

Release overview Shipment booking

Cepheo Subscription

Cepheo Test and Certification

Cepheo Timesheet Extension

- All Categories

- Cepheo SAF-T reporting

- SAF-T Reporting

- Reporting (common)

Reporting (common)

When you have completed referencing your own chart of accounts and your tax codes with the Tax Administration, you are ready to report your figures and thereby fulfill the authorities' SAF-T reporting requirements.

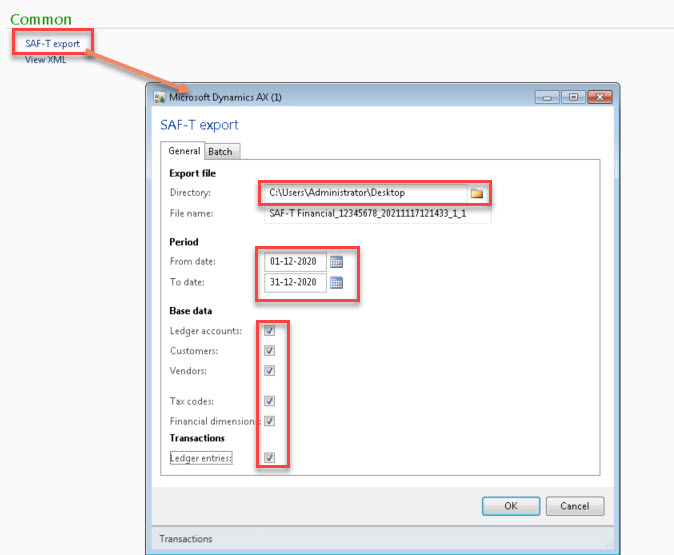

Where to?

Directory: Enter the file path where to store the report.

File name – (Naming the SAF-T-data) It is strongly recommended to keep and use the following naming convention to secure necessary information in the file name. The purpose is to identify which data is in the file, the owner of the data, and to create a unique file name for each export. The solution will automatically suggest a file name that follows this definition:

According to page 9 in Norwegian SAF-T Financial data Dokumentation v1.5 – 25.11.2020

- Limitations in the Altinn portal is 200MB per attached file, and 2 GB of source XML data. All single XML files submitted must validate with the schema.

- … When dividing one export/selection to several files, care must be taken to name the files in order so they can be treated properly when assembled by the party receiving the files.

- …The maximum submission is 32 GB of raw XML data, per attachment. This must comply with the limitation of 200 MB per attachment, and 2 GB file size per XML.<<

Period (from and to date): Enter the period to export

Export all / Export: Mark which data to export