Cepheo Advanced Ledger Import

Cepheo Business Documents

Document examples

Business Documents configuration

General for all documents

Sales order configuration

Sales invoice

Sales packing slip

Purchase order

Project invoice

Quotation

Interest note

Work report

Dynamic payment information

Release notes Cepheo Business Documents

Cepheo Currency Import

Cepheo Engineering

Cepheo Engineering - Functional overview

Engineering setup

Engineering parameters

Engineering global parameteres

Change notification parameters

Classification Codes Setup

Item property setup

Manufacturer Setup

Material Quality Setup

Product setup

Spare Parts Setup

Released Item Setup

How to use Engineering

Release overview Engineering

Cepheo Expense Extension

Cepheo Expense Power App

Cepheo Foundation

HowTo

License overview

Model upload

Business events

Release overview Foundation

Release notes Foundation

Base.2022.11.2.21

Base.2022.8.2.19

Base.2022.8.2.16

Base.2022.8.2.15

Base.2022.2.2.11

Base.2022.2.2.10

What is Cepheo Foundation

Cepheo Human Resources Extension

Setup Human Resources Extension

Use Human Resources Extension

Release notes Human Resources Extension

What is Human Resources Extension

Cepheo Installation

Setup Installation

How to use Installation

Release overview Installation

Cepheo MVA-melding

MVA Setup

MVA Reporting

Step 4: Reporting

Step 4 | Section 1: Tax reports

Step 4 | Section 2: Standard tax codes

Step 4 | Section 3: Tax specifications

Step 4 | Section 4: Report remark

MVA Multicompany setup

MVA Intercompany setup

MVA Intercompany Tax report

Cepheo SAF-T reporting

Cepheo Sales Integration

Cepheo Shipment Booking

Shipment booking setup

Shipment booking external values

Transform addresses, senders and recipients to address quick ID's

Transform label

Transform carrier information

Transform country, state and county

Transform currency code

Transform print favorite

Transform shipment payer account

Transform container types

Transform shipment booking status

Transform security group

Shipment booking parameters

Document transformations

Shipment booking senders

Shipment booking labels

Shipment booking print favorites

Shipment booking security group (nShift Delivery)

Carrier container type

Shipment booking cost rule

Import Carrier setup

Setup of carriers

Shipment booking Sender

Shipment booking app setup

How to use Shipment booking

Notification contacts

Consolidate shipment bookings from Create Shipment booking dialog

Maintain content lines on a Container on a Shipment booking

Release overview Shipment booking

Cepheo Subscription

Cepheo Test and Certification

Cepheo Timesheet Extension

- All Categories

- Cepheo Expense Extension

- Expense Extension Setup

- Setup Cepheo Expense Extension

Setup Cepheo Expense Extension

Updated

by Frank Johansson

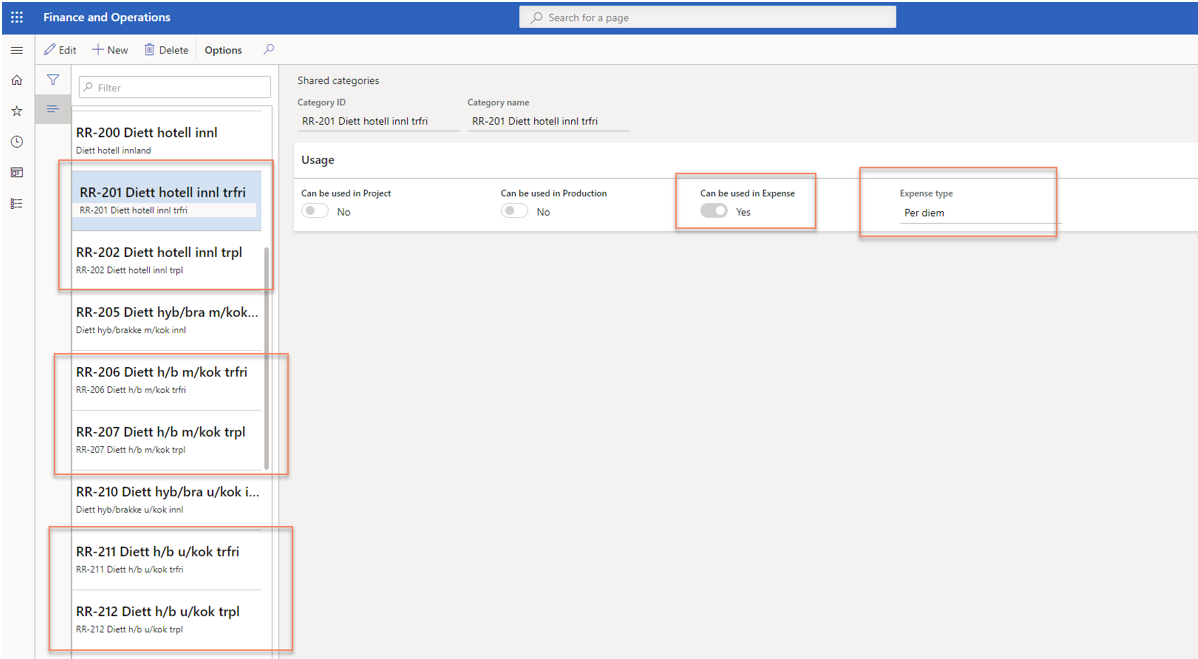

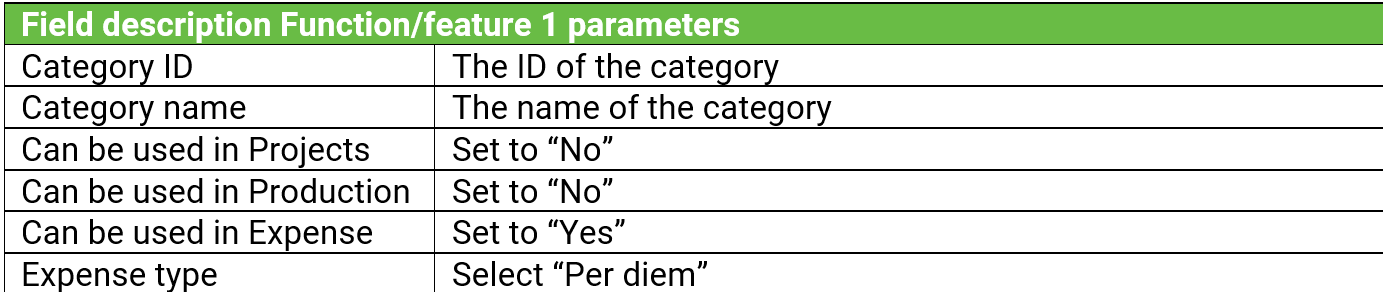

Creation of two Per diem tax categories for each Main category.

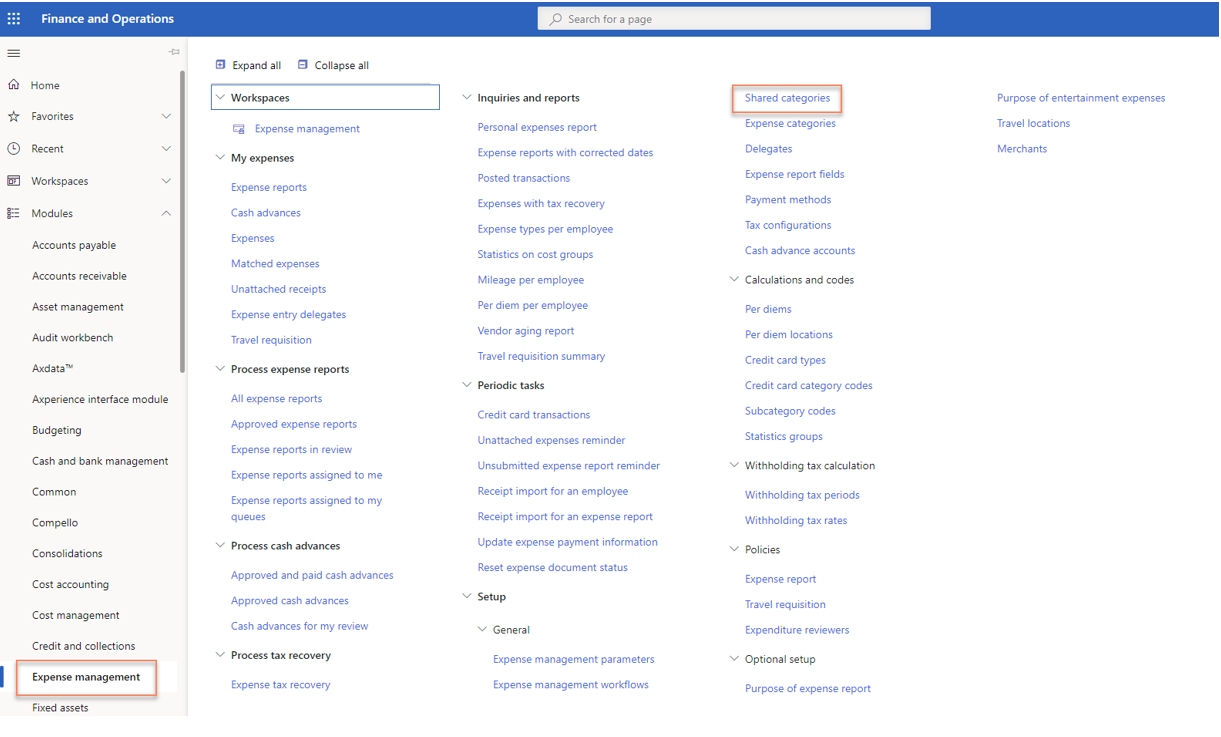

Navigate to: Expense Management > Setup > General > Shared categories

Name the new categories as you like, but we recommend that you name them the same as the main category only with the first category referring to “Taxable” and the second category referring to “Non-taxable”.

Set the Usage for each category as described in the table after the screenshot under.

· For Main category RR-200: Create RR-201 (taxable) and RR-202 (non-taxable)

· For Main category RR-205: Create RR-206 (taxable) and RR-207 (non-taxable)

· For Main category RR-210: Create RR-211 (taxable) and RR-212 (non-taxable)

· For Main category RR-215: Create RR-216 (taxable) and RR-217 (non-taxable)

· For Main category RR-220: Create RR-221 (taxable) and RR-222 (non-taxable)

· For Main category RR-230: Create RR-231 (taxable) and RR-232 (non-taxable)

· For Main category RR-245: Create RR-246 (taxable) and RR-247 (non-taxable)

· For Main category RR-250: Create RR-251 (taxable) and RR-252 (non-taxable)

Activate the Per diem tax categories and assign them to the correct Main category

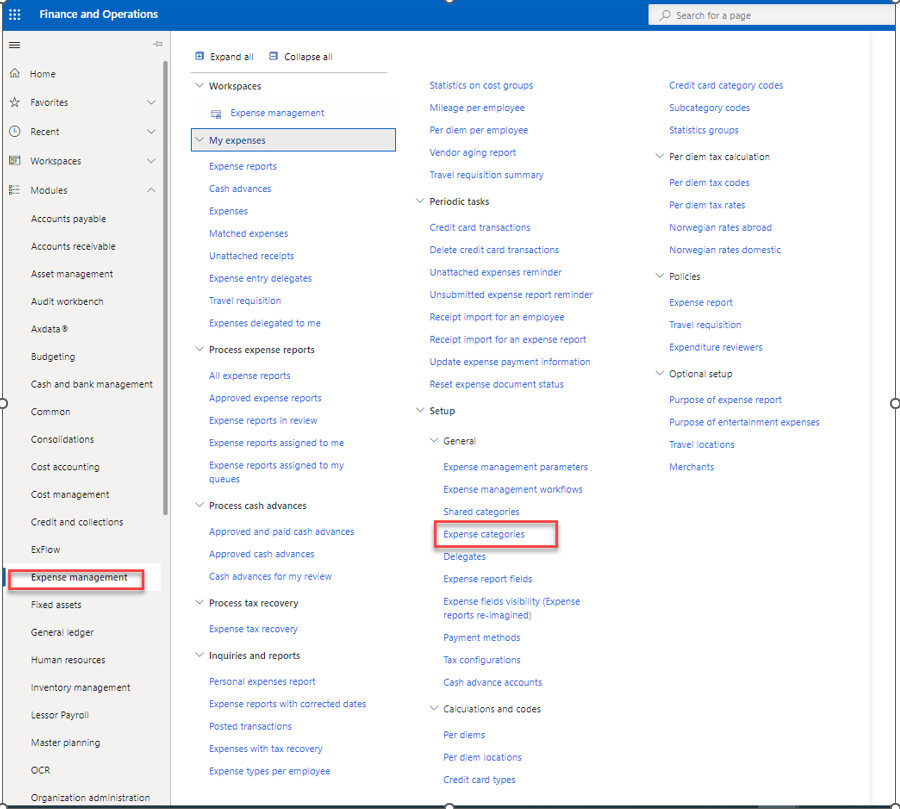

Navigate to: Expense Management > Setup > General > Expense categories

Activate the per diem categories you created

Click “New” and select one of the categories you created in section 1 (when a category is selected here, it will not be shown in the drop-down list anymore, so it’s not possible to select the same category twice). Do this for all the categories that will be used in the current Legal Entity and have the parameters for each category set as shown in the image below (when “Hidden in category lookup” is set to Yes, employees will not see this category. They will only see the main category that they should choose when creating an expense report):

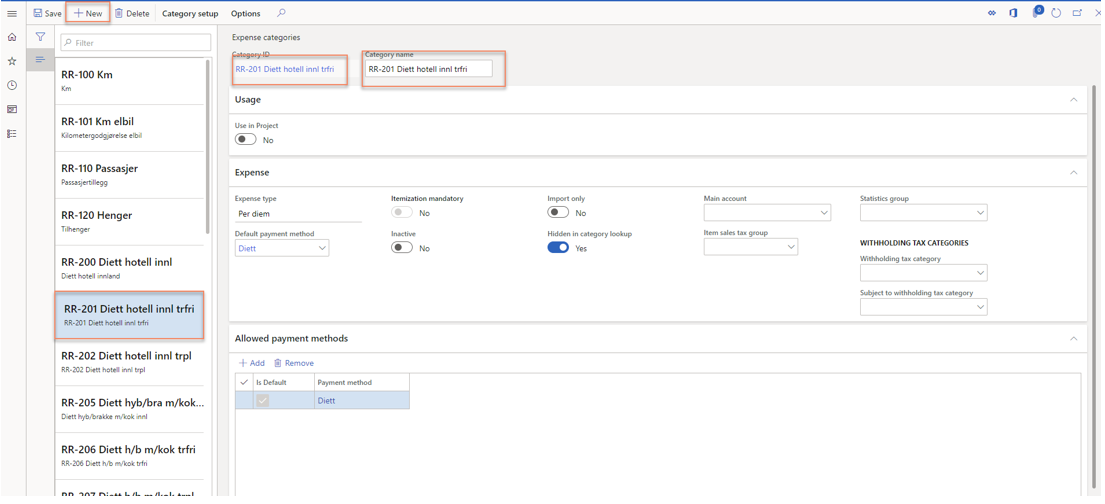

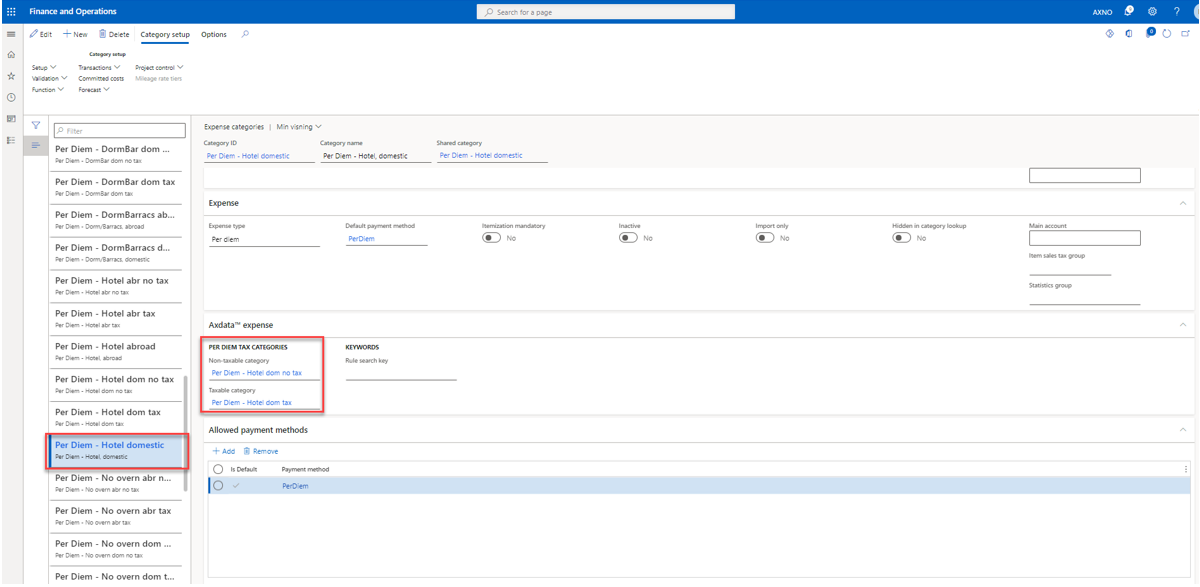

Assign the Per diem tax categories to the correct Main category

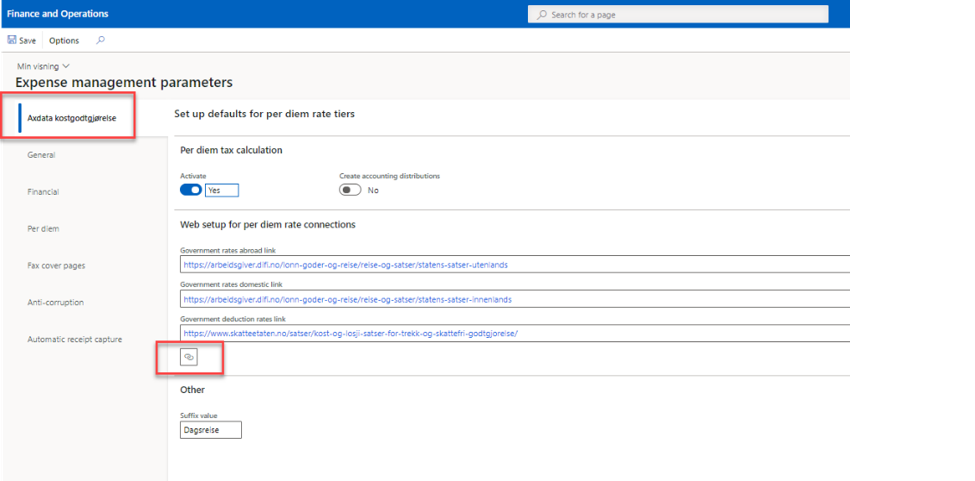

Select the first main category, RR-200. Under the Expense area, select RR-201 as the “Taxable category” and RR-202 as the “Non-taxable category”. Do the same for all the Main categories:

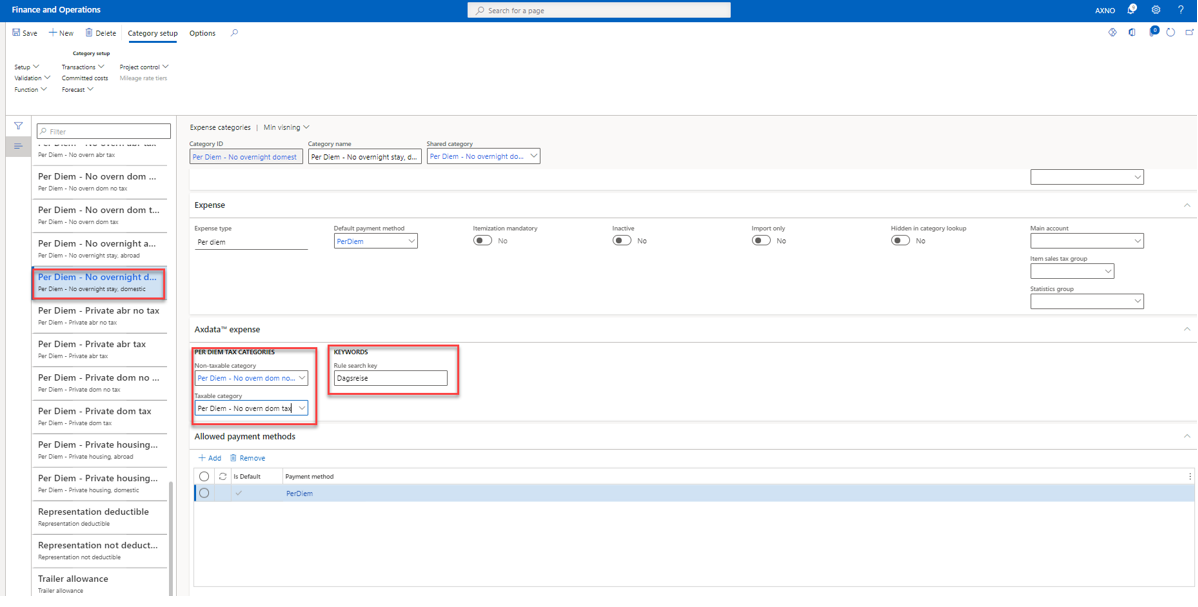

For expense categories without overnight stay you also have to type in a Keywords, Rule search key. This have to be the same that is typed in under Expense management parameters, "Cepheo kostgodtgjørelse", Suffix value.

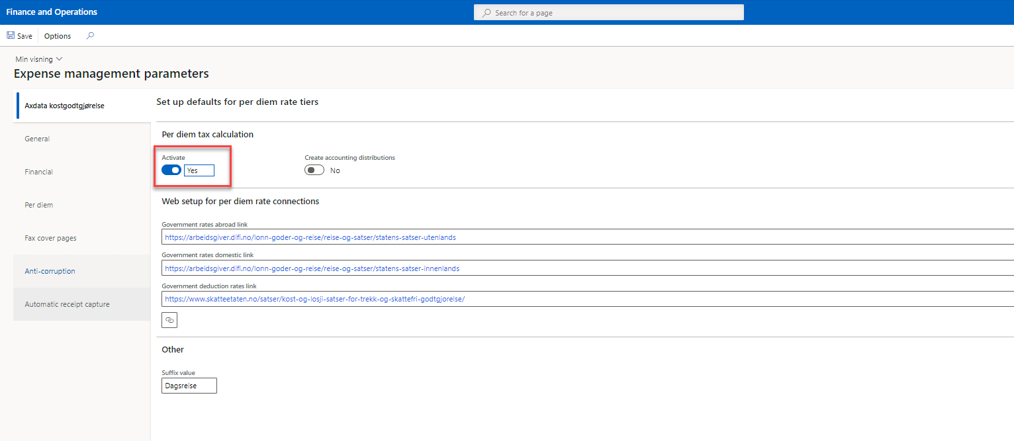

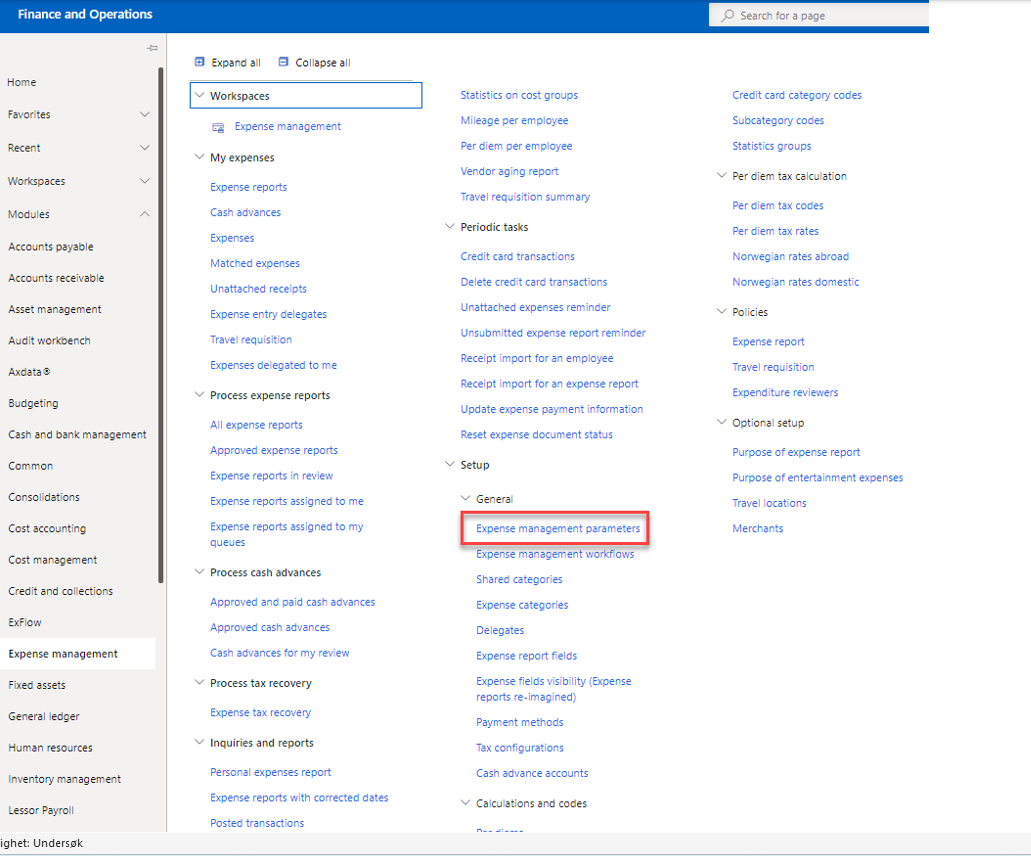

Expense Extension, Setup, General, Expense management parameters, "Cepheo Kostgodtgjørelse"

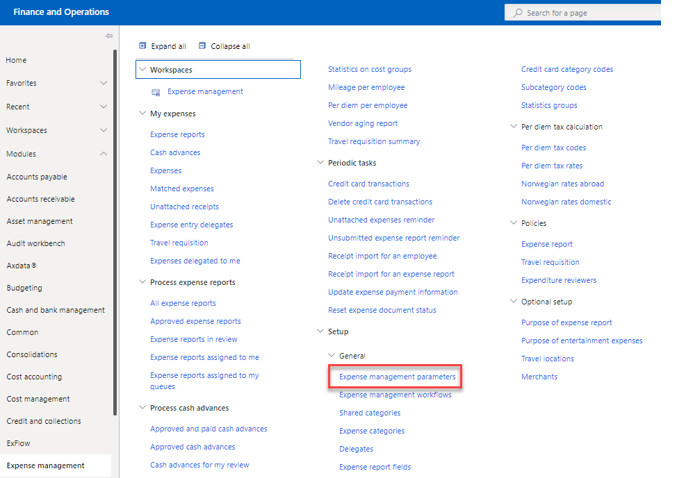

Navigate to: Expense Management > Setup > General > Expense management parameters

Press the menu button marked in red below, and the URL’s will automatically be filled in.

The parameter Activate shall not be put to YES before the whole setup is done.

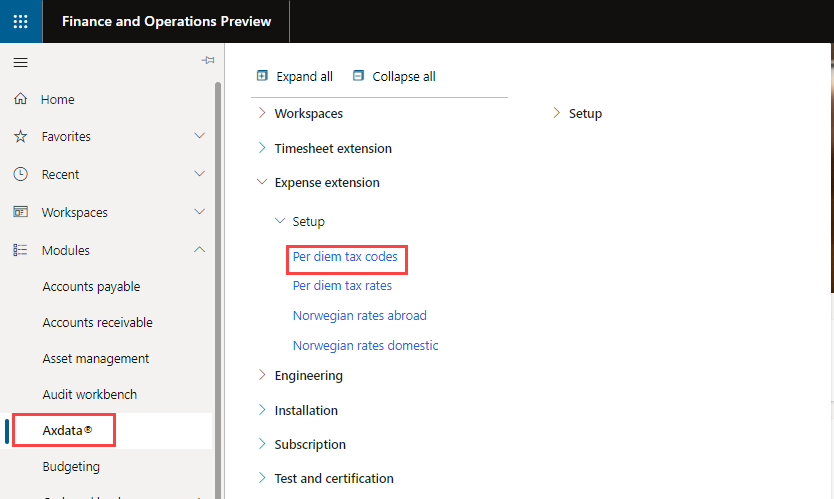

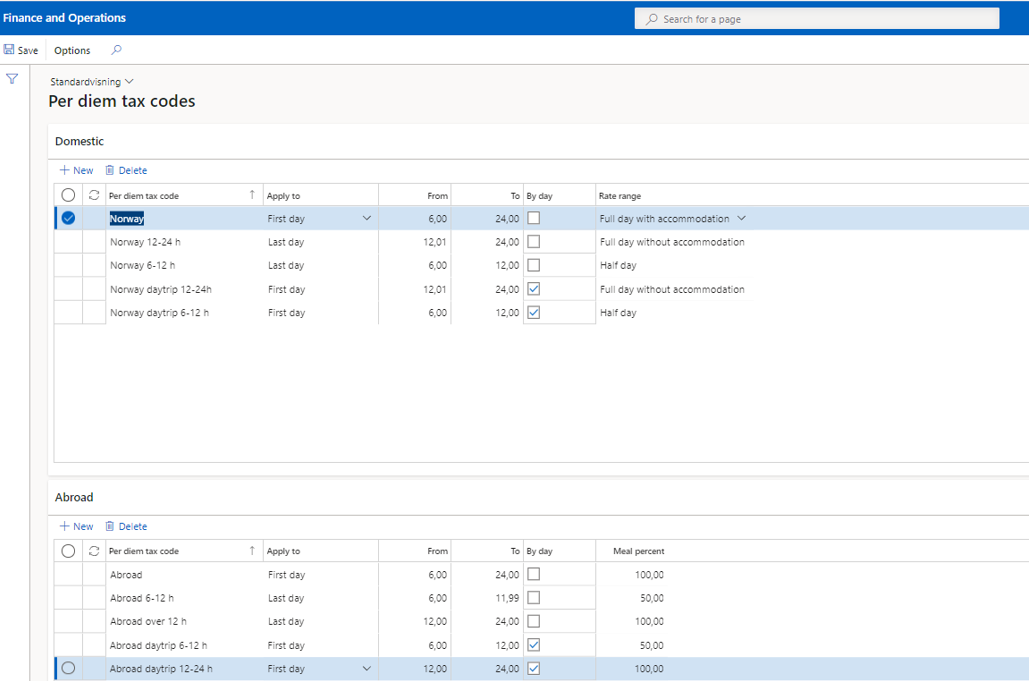

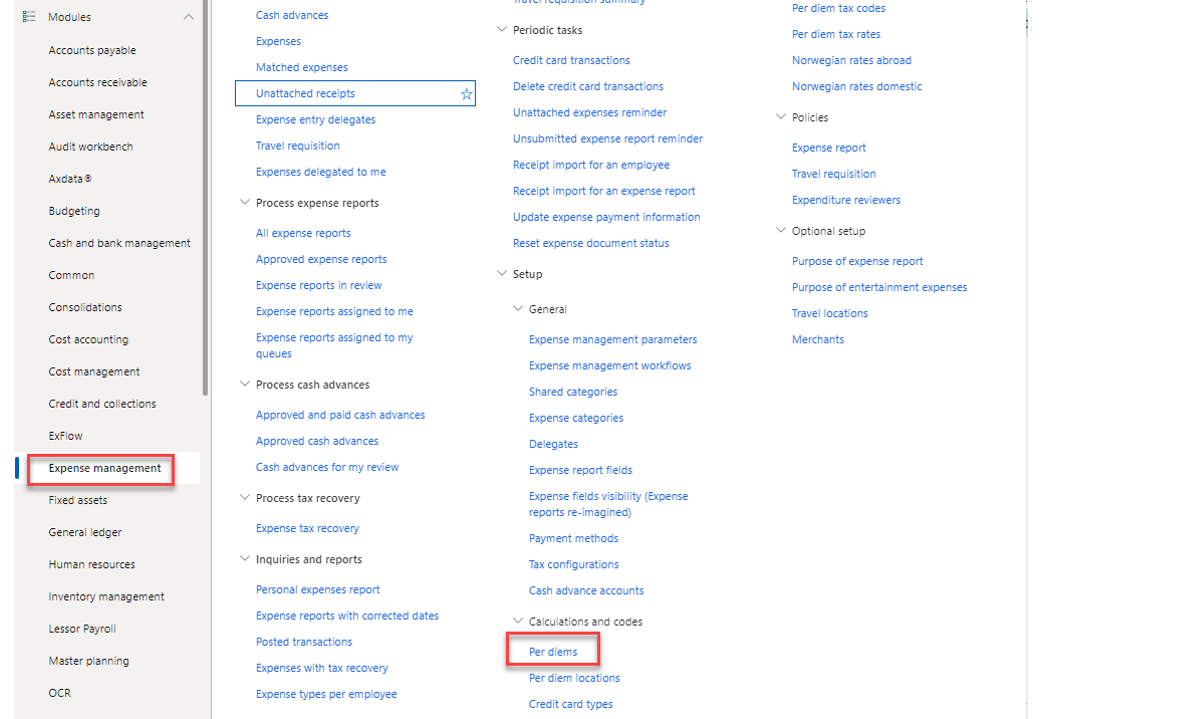

Create Per diem tax codes

Navigate to: Cepheo Expense extension > Setup > Per diem tax codes

Create the codes as shown in the screenshot under. The names in the screenshot are examples, you can name them as you like, but make sure that all the different periods are created

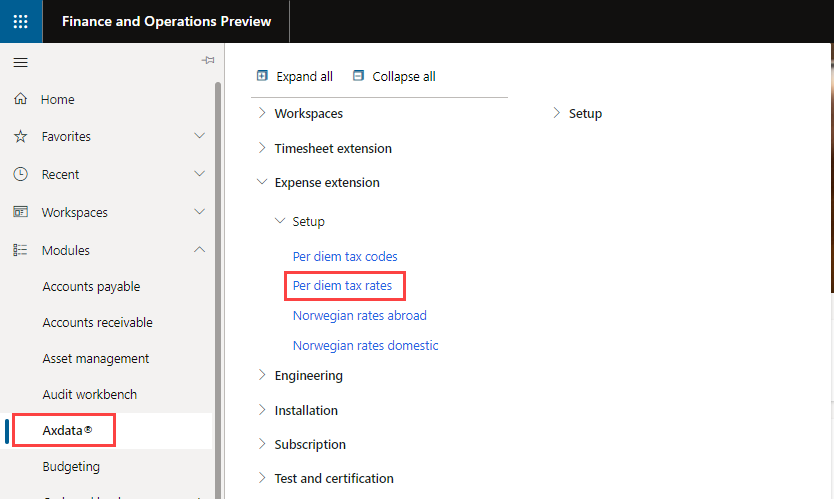

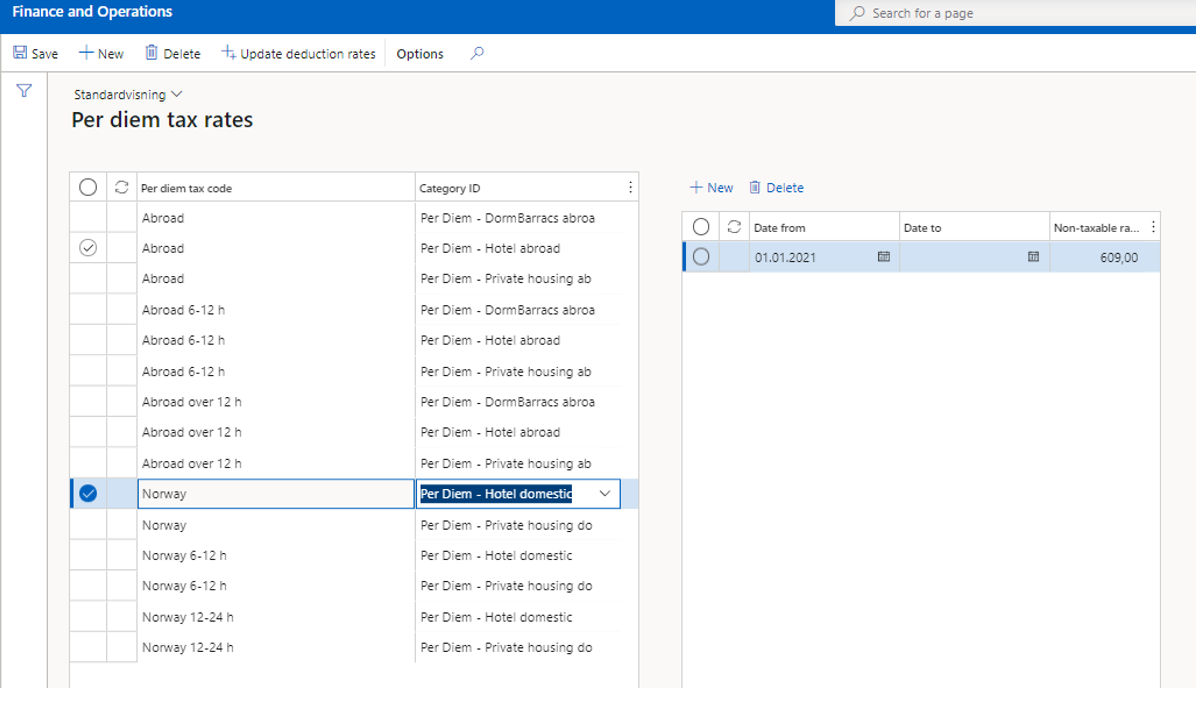

Create Per diem tax rates

Navigate to: Cepheo Expense extension > Setup > Per diem tax rates

Connect the Main categories to all the “Per diem tax codes” that is valid for the Main category and state the rate that is valid for this year. Click “+ New” in the upper left corner, select the Per diem tax codes and Main category, and state the valid rate. These rates must be updated every year.

The picture under shows the connection for Main category “RR-200” and Per diem tax codes “Norge” as an example, and the table on the next page lists all connections that normally has to be set up (as stated earlier, the names of the categories are examples):

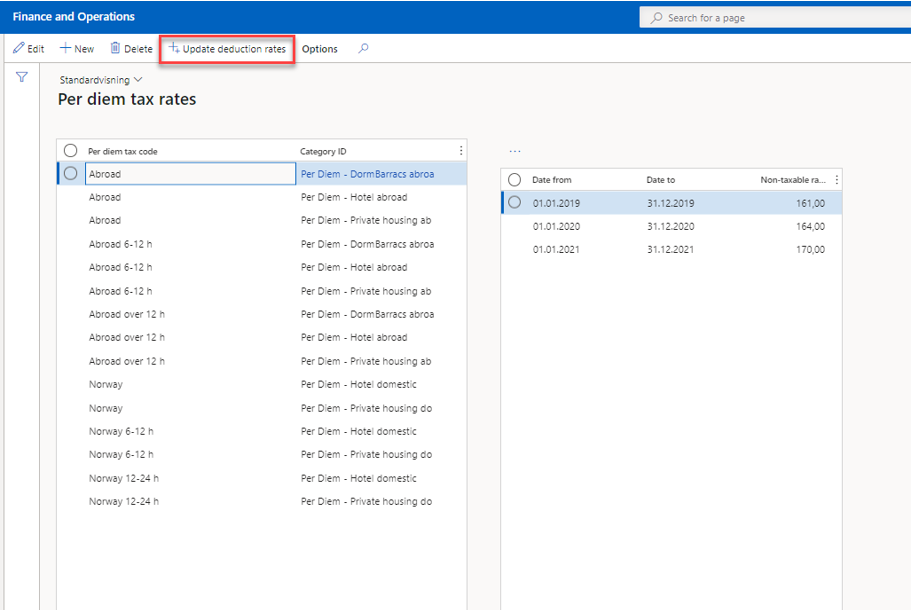

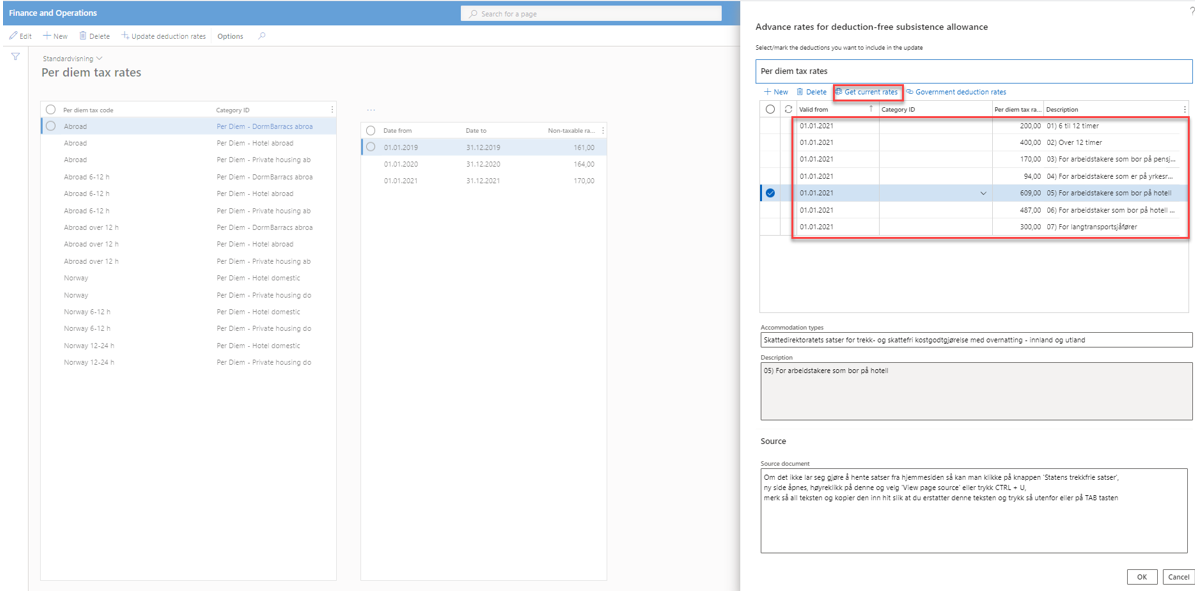

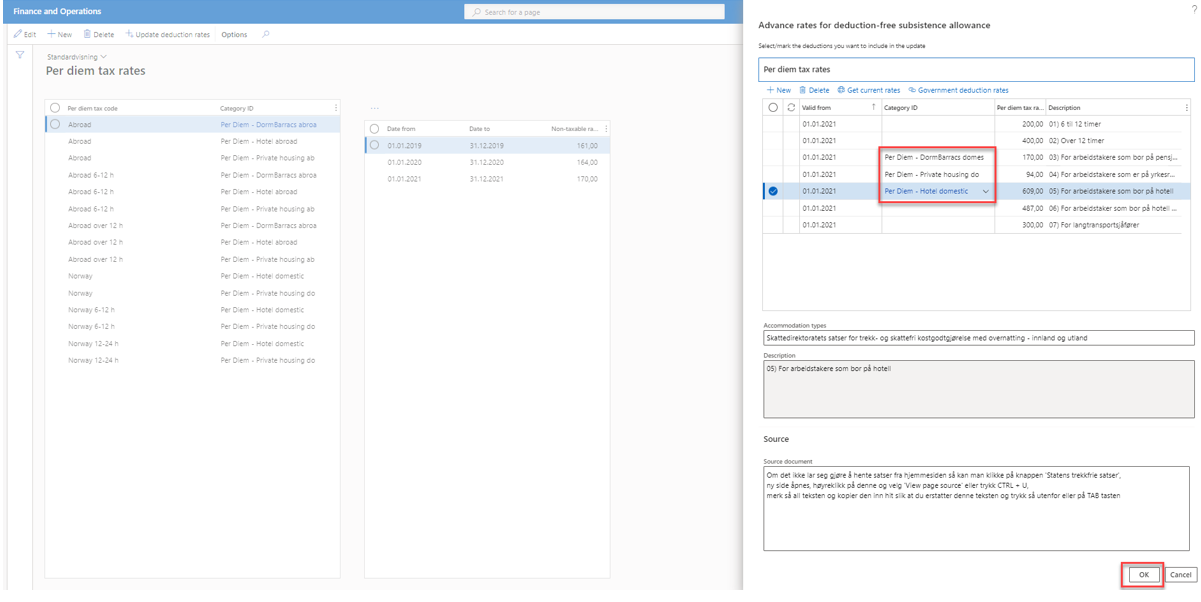

Non-taxable rates can be imported. Select Update deduction rates as marked in the picture below:

Select Get current rates.

The rates will come as marked in the picture below.

For updating rates for different Expense categories, put in Category ID and click on OK

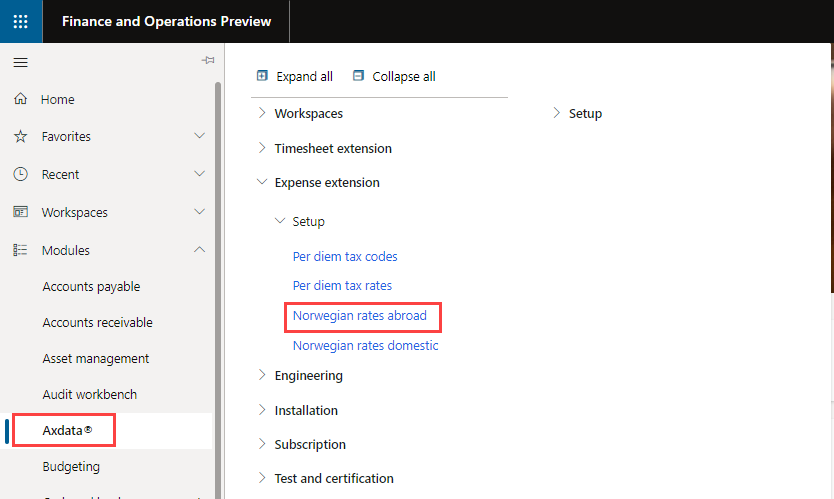

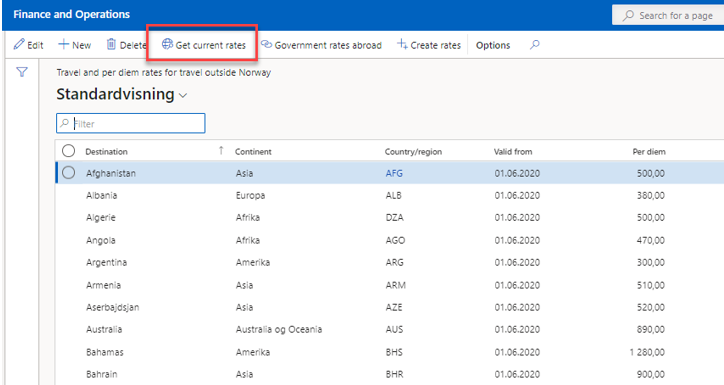

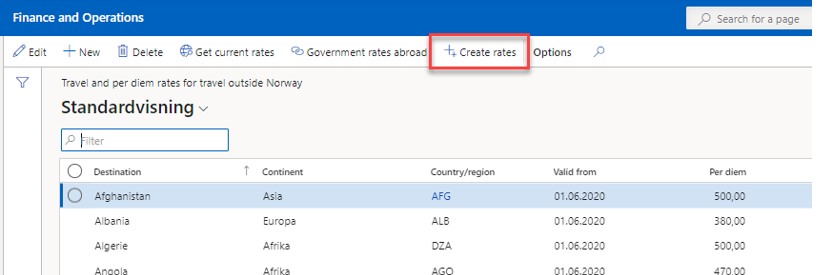

Norwegian rates abroad

Navigate to: Cepheo Expense extension > Setup > Norwegian rates abroad

Select Get current rates.

They will be listed like the picture below.

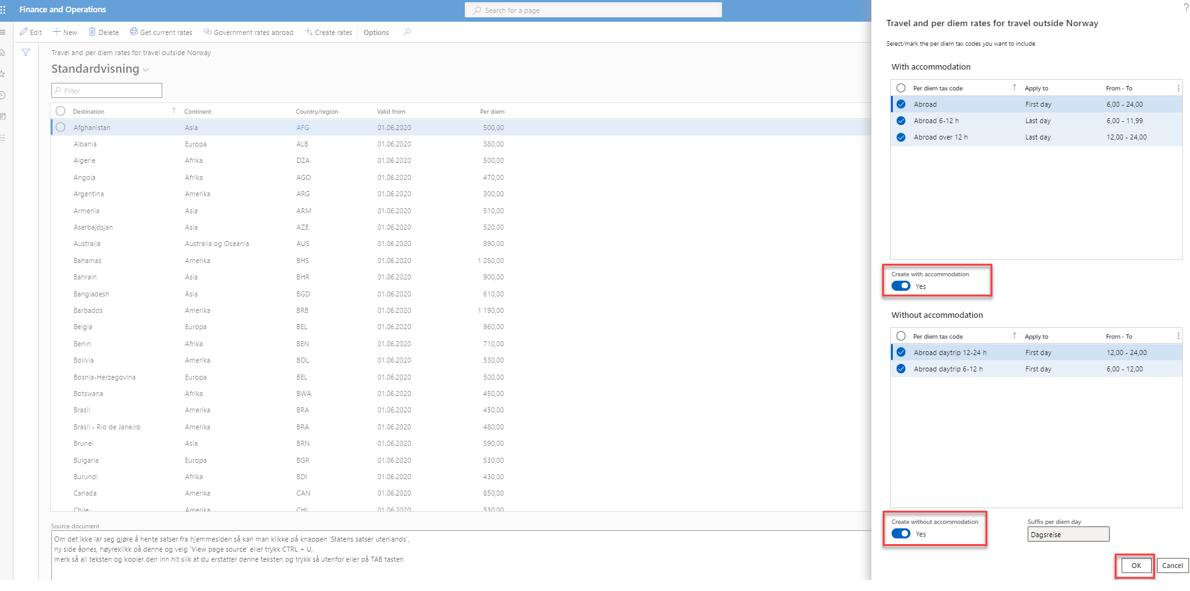

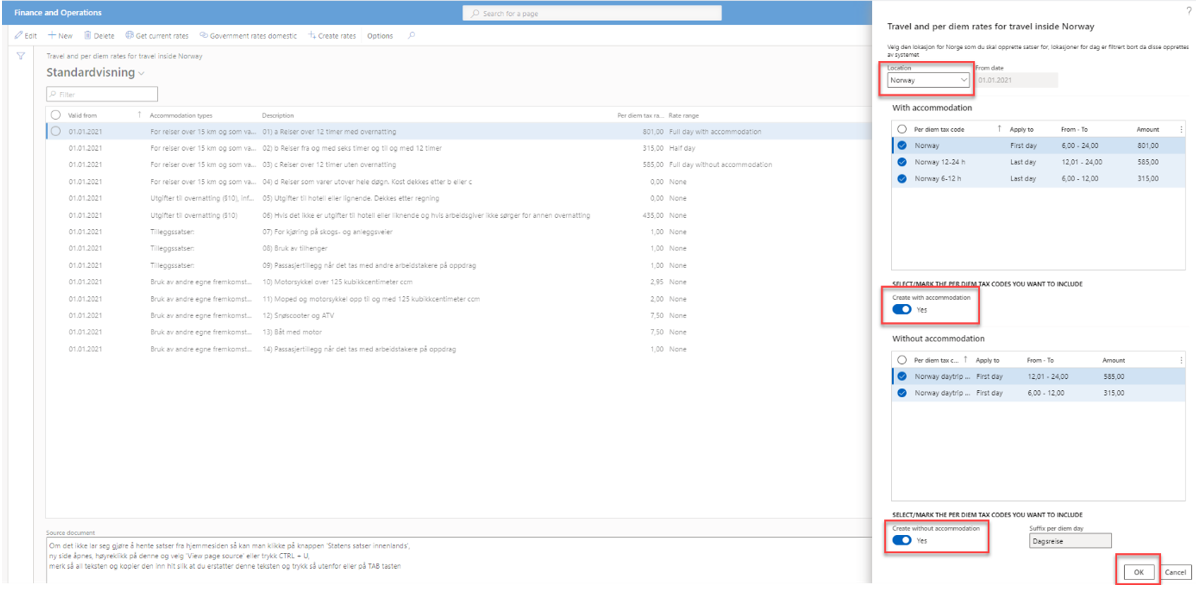

Select one, some or all Destination and select Create rates.

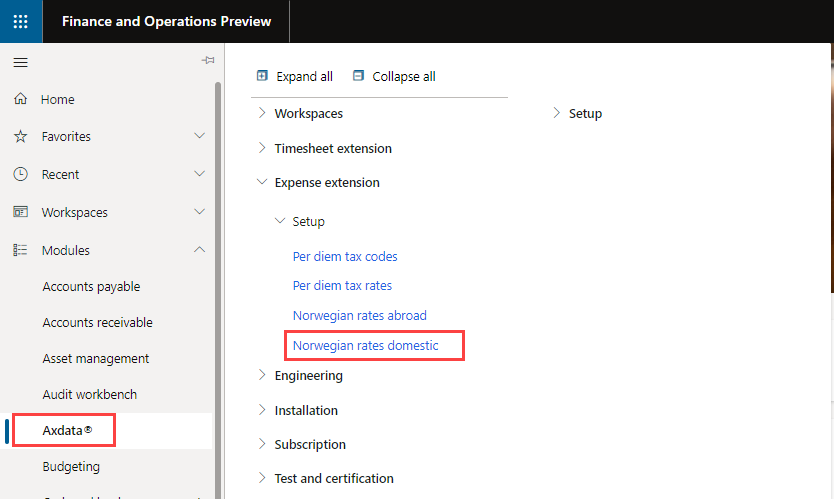

Norwegian rates domestic

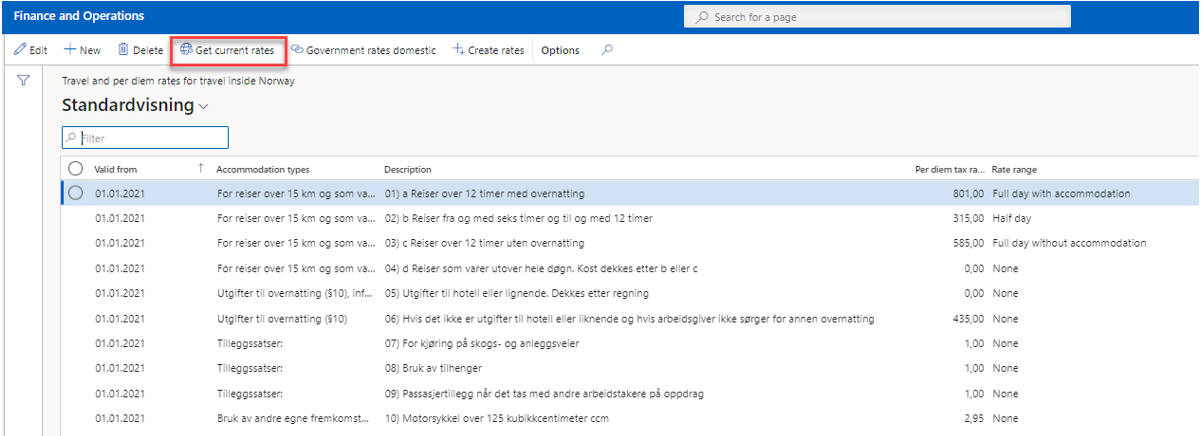

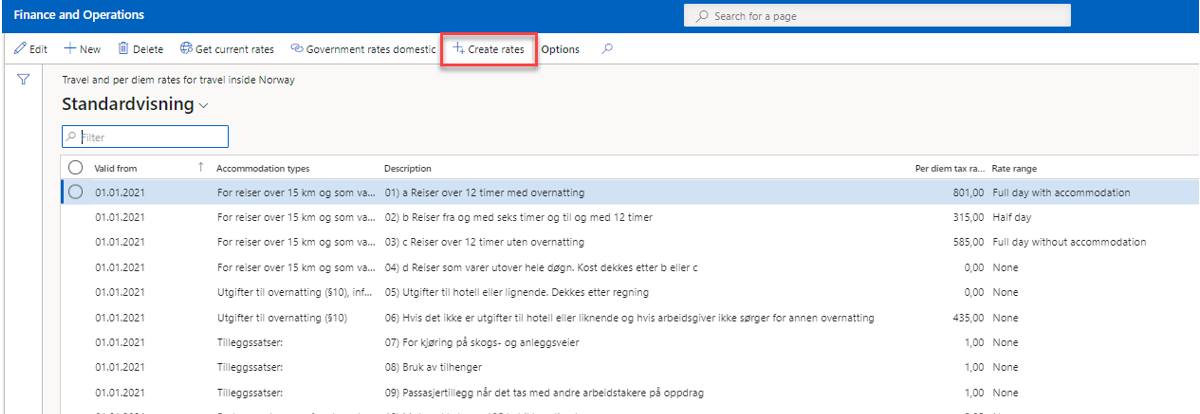

Navigate to: Cepheo Expense extension > Setup > Norwegian rates domestic

Select Get current rates.

After importing rates, select Create rates.

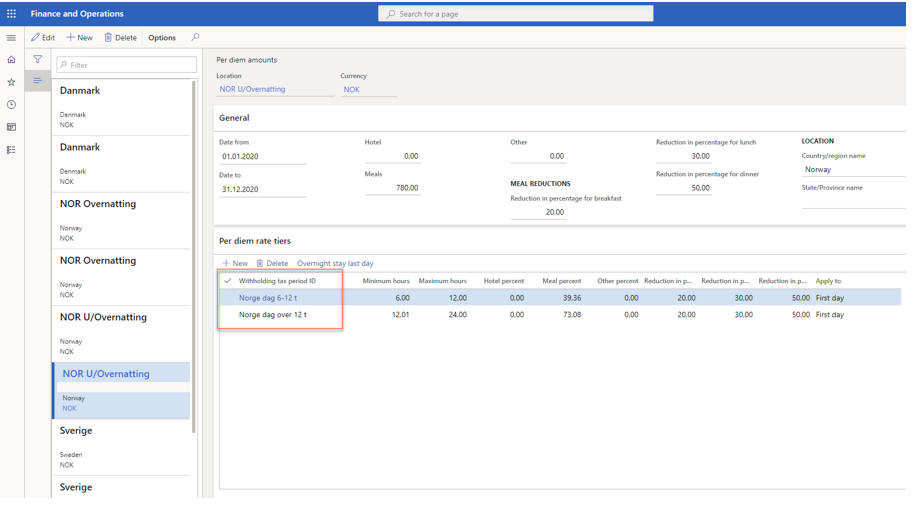

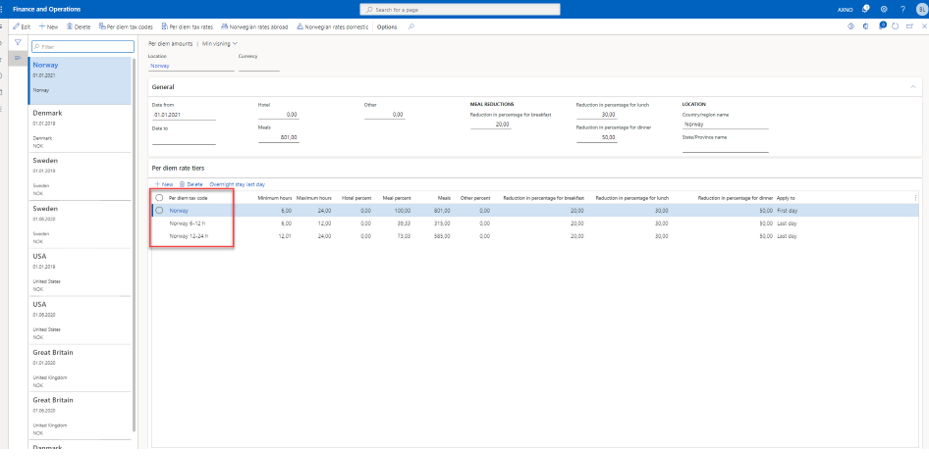

Connect Per diem codes to Per diem amounts

Navigate to: Expense Management > Setup > Calculation and codes > Per diems

To create domestic without overnight stay, select “NOR U/Overnatting” and insert the Withholding tax periods as shown in the screenshot under:

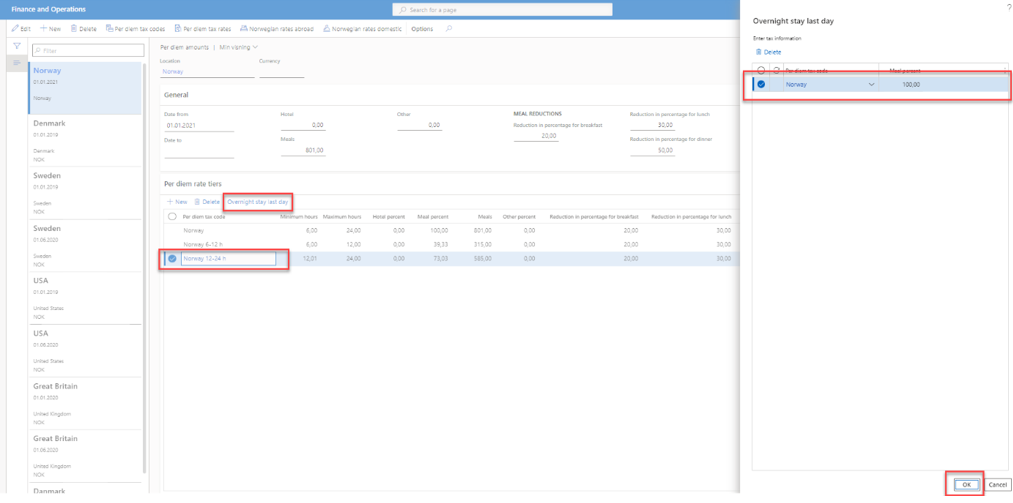

To create domestic with overnight stay, select “NOR Overnatting” and insert the Withholding tax periods as shown in the screenshot under:

Select the last line (having hours from 12,01 to 24,00) and click “Overnight stay last day. In the new window, select “Norge” as the Withholding tax period ID and set the “Meal percent” to 100,00:

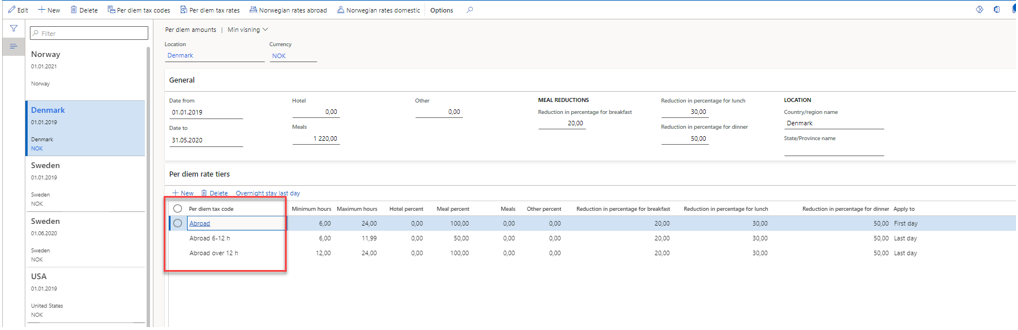

International: We have used Denmark as an example here, but select the different international countries you have listed here, and insert the Per diem tax codes as shown in the screenshot under:

Per diem tax calculation

Navigate to: Expense Management > Setup > General > Expense management parameters

Turn on Per diem tax calculation

Under “Cepheo Kostgodtgjørelse”, turn on the “Per diem tax calculation active. This needs to be done after the full setup has been completed. When this is turned on, the calculation will be as wanted when employees start to fill out their expense reports.

If wanted, the “Create accounting distributions” can be turned on if you want D365 to create a financial transaction for the per diem tax part of the expense report submitted: